Looking to better understand how Brazilian financial operations can impact your investment strategy?

Check out our in-depth guide on the IOF (Tax on Financial Operations) — a must-read for companies dealing with loans, currency exchange, insurance, or capital flows in Brazil.

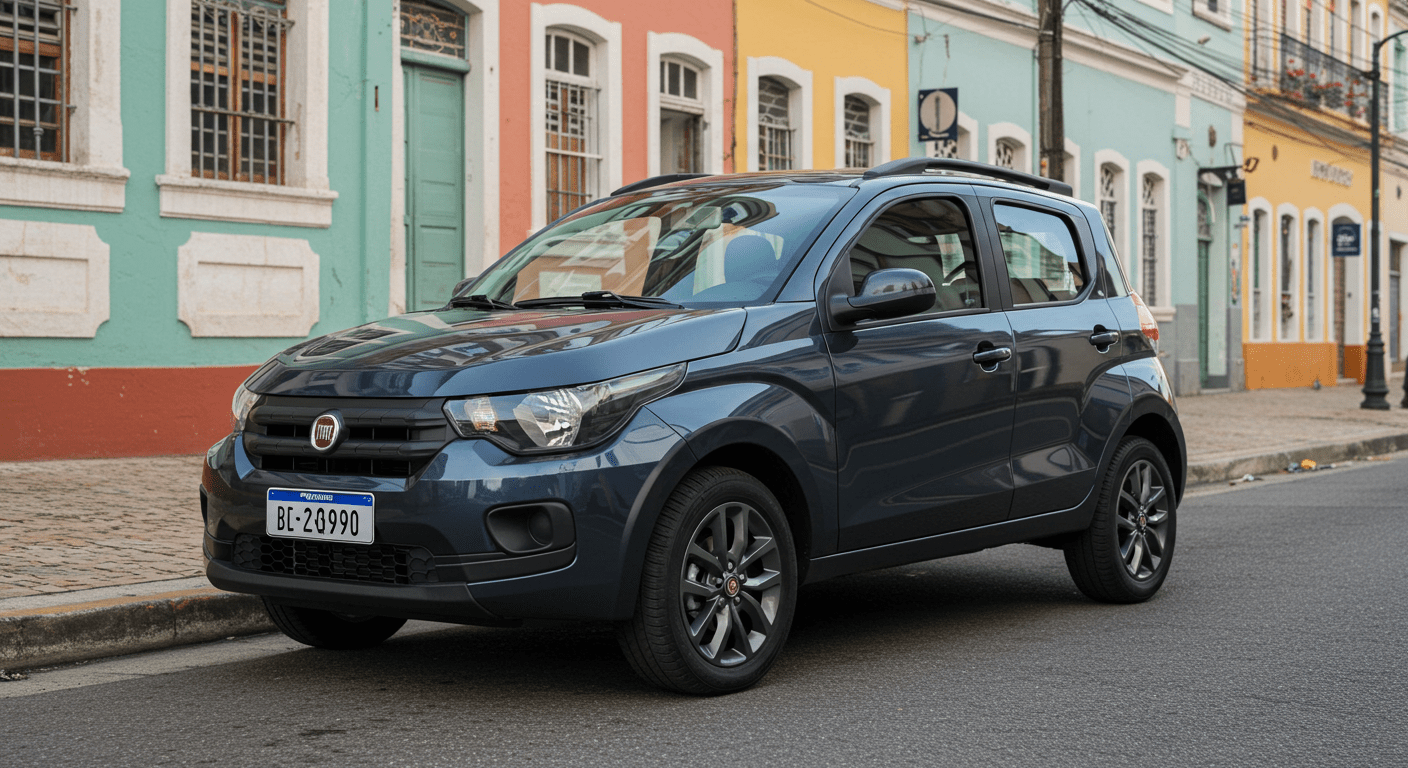

Brazil’s Automotive Market at a Glance: Brazil is Latin America’s economic powerhouse and home to one of the world’s largest automotive industries. In 2024, new vehicle sales rebounded to 2.63 million units, marking a 10-year high and restoring Brazil’s status as the 8th largest automotive market globally. Annual vehicle production has hovered around 2–2.5 million in recent years en.wikipedia.org, and the country hosts manufacturing plants of virtually all major global automakers – from Volkswagen and General Motors to Toyota, Stellantis (Fiat/Jeep), Honda, and newcomer BYD en.wikipedia.org. This deep presence of international OEMs and suppliers reflects the significant business opportunities in Brazil’s auto sector. With a population of over 210 million and belonging to the Mercosur trade bloc, Brazil offers a large domestic market and preferential access to regional neighbors for automotive trade. The industry encompasses not only assembly of passenger cars, trucks, and buses, but also a vast auto parts supply chain, presenting opportunities for component manufacturers, service providers, and innovators in areas like flex-fuel technology and electric mobility.

Jeep Renegade – a compact SUV locally produced in Brazil. The country’s market is dominated by flex-fuel vehicles (ethanol/gasoline) and has recently seen growth in hybrid and electric models, signaling opportunities in green mobility. en.wikipedia.org

Brazil’s auto market outlook is positive, with industry projections indicating continued growth. ANFAVEA (the national automakers’ association) forecasted an increase in vehicle output and exports for 2025. The government, for its part, has shown commitment to supporting the sector’s evolution – for example, through programs like Rota 2030 (discussed later) which incentivize innovation, efficiency, and safety improvements. Foreign investors will find not only a robust consumer base – Brazil’s rising middle class fuels demand for cars and motorcycles – but also emerging niches. These include the expansion of electric and hybrid vehicles, digital automotive services, and opportunities to integrate into global supply chains. In short, Brazil remains the largest automotive market in Latin America and a strategic foothold for production and R&D in the region.

Legal Requirements for Foreign Companies in Brazil’s Auto Sector

Legal Requirements for Foreign Companies in Brazil’s Auto Sector

Entering Brazil’s market as a foreign business involves navigating local legal structures and regulations. Fortunately, Brazil welcomes foreign investors – there is no general restriction on foreign capital, and nearly all sectors

(including automotive manufacturing and sales) are open to 100% foreign ownershipapexbrasil.com.brapexbrasil.com.br. Below is an overview of key legal considerations:

Types of Legal Entities and Ownership Rules

Foreign investors typically choose between two common legal entities in Brazil: the Limitada (Ltda.) and the Sociedade Anônima (S.A.). A Limitada is analogous to a limited liability company, while an S.A. is a corporation. Both offer limited liability to their shareholders/quotaholders and are the most frequently used business forms for subsidiaries or joint ventures. In practice, most small and medium foreign enterprises opt for a Limitada due to simpler corporate governance, whereas large ventures or those planning to raise capital may prefer an S.A.

Notably, Brazil does not require a local partner or minimum capital for most businesses. A foreign individual or company can own 100% of a Brazilian entity’s equity. Some regulated industries (like banking, media, and defense) have ownership caps or require special approvalsapexbrasil.com.brapexbrasil.com.br, but automotive manufacturing is not on that restricted list. Foreigners can also serve as directors or managers of the Brazilian company, though if they are non-resident, they must appoint a local Brazilian representative (attorney-in-fact) to receive legal notices on their behalf. In general, the absence of forced joint ventures means overseas automakers or suppliers can establish fully controlled subsidiaries in Brazil.

Business Registration Steps and Incorporation Process

Business Registration Steps and Incorporation Process

Setting up a company in Brazil involves several bureaucratic steps, and the overall process can take a few weeks to a few months. Brazil ranked 138th globally in ease of starting a business (World Bank, 2020), reflecting the historical complexity. However, recent reforms – such as integration of registration systems and online filings – are steadily improving efficiency. For example, the government digitized the process for opening branches of foreign companies, cutting approval times from ~45 days to just 3 days in some cases gov.br. Here is a checklist for setting up an automotive business in Brazil:

- Choose and Reserve a Company Name: Check availability and reserve the legal name with the state Board of Trade (Junta Comercial). The name must reflect the business activity and comply with naming rules.

- Determine the Legal Structure: Decide between Ltda., S.A., or other structures (such as a branch office of the foreign company). Most investors opt for a Limitada (LLC equivalent) for its simplicity.

- Draft Incorporation Documents: Prepare the company’s constitutive documents – Articles of Association (Contrato Social) for a Ltda., or Bylaws for an S.A. – in Portuguese. These must list the business purpose (e.g. manufacturing or trading auto parts), capital contribution, registered address in Brazil, management structure, etc. If any shareholder or director is a foreign entity/individual, their documents (like passports, certificates of good standing) must be translated to Portuguese and notarized/apostilled in their home country.

- Register with the Board of Trade: Submit the signed incorporation acts to the Junta Comercial of the company’s state for approval. This registration formally creates the company. Processing typically takes several weeks. though timelines are improving with online systems. Once approved, the company is issued a registration number at the Board of Trade.

- Obtain Tax ID (CNPJ) and Register with Tax Authorities: After the Board of Trade, register the company with the Federal Revenue (Receita Federal) to obtain a CNPJ (Cadastro Nacional da Pessoa Jurídica). The CNPJ is the company’s tax identification number, required for all financial and commercial activities. As part of this step, any foreign shareholders must be enrolled in the taxpayers’ registry – foreign individuals get a CPF (Cadastro de Pessoa Física), and foreign corporate shareholders get their own CNPJ as “foreign investor” entities. This is a one-time registration so the tax authority can track foreign ownership.

- Register Foreign Capital with Central Bank: When injecting capital from abroad (whether as equity investment or intercompany loans), register the inflow with the Brazilian Central Bank through the RDE-IED online system within 30 daysapexbrasil.com.brapexbrasil.com.br. This registration is mandatory for future profit repatriation or capital repatriation – unregistered investments cannot legally have dividends remitted abroadapexbrasil.com.br. The process is straightforward online, but often overlooked, so ensure compliance here.

- State and Municipal Registrations: Register with the state tax authorities (SEFAZ) for ICMS (if the company will engage in sales of goods or transportation) and with the municipality for a local tax registration (for ISS – service tax – if providing services). Also obtain any operating permits from the city (an Alvará de Funcionamento or business license for the location).

- Obtain Sectoral Licenses and Environmental Permits: An automotive manufacturing or distribution business may require additional permits. For example, environmental licensing is crucial if you are setting up a factory or any facility with potential environmental impact. Brazil’s environmental licensing process has three phases – a preliminary license, installation license, and operating license – which must be obtained from the competent environmental agency (usually the state’s environment department) before constructing and running an industrial plant. Auto manufacturers also typically need certification from regulatory bodies for their products (such as INMETRO safety certification for vehicles/parts and compliance with emissions standards PROCONVE – see Environment section below). Ensuring compliance from the outset will smoothen your launch.

- Hire Staff and Register for Social Security: Once you start hiring, the company must register as an employer with social security (FGTS/INSS systems) and adhere to labor laws (see Labor section). Often, companies also join industry unions or associations (e.g., Sindipeças for auto parts, or even ANFAVEA as an automaker) for industry-specific guidance and collective labor agreements.

- Open Bank Accounts and Fund the Company: With the local company formed and CNPJ obtained, you can open a corporate bank account in Brazil. Initial capital can then be wired in (and must be reported via Central Bank as noted). Brazil’s banking system is modern, but foreign account signatories will need their CPF and often a Brazilian address. CLM Controller can provide guidance to investors on banking, financing, and other start-up issues.

Each step comes with documentation requirements, and the timeline can range from 1 to 3+ months depending on the complexity (as a reference, incorporation alone might take 60–90 days in some cases). Hiring a local legal firm or consulting service is highly advisable to navigate the process. Despite the paperwork, Brazil has improved its business climate with digital portals – for instance, many filings can now be done through the gov.br integrated platform, reducing the need for in-person submissions.Visa Options for Foreign Investors and EmployeesIf you, as a foreign investor, or your foreign personnel will be working in Brazil, you must consider visa requirements. Brazil distinguishes between short-term business visits and residency for investment or work:- Business Travel (VIVIS): For attending meetings, conferences, or exploratory visits, many nationals can use a visitor visa (VIVIS) or even visa-free entry (for certain countries, including the US, EU, etc., under reciprocity agreements). A business visitor visa allows stays up to 90 days for activities like meetings, signing contracts, or prospecting gov.br. No paid employment is allowed under a business visitor status gov.br.

- Work Visa (VITEM V/Temporary Visa): To hire foreign staff or post expatriates to your Brazilian entity, you will need to obtain work authorization. Under Brazil’s 2017 Migration Law, there are categories of temporary visas for work (including technical roles, management, etc.). Typically, your company in Brazil must sponsor the visa by demonstrating the need for a foreign worker and that the individual has the qualifications. Common types include visas for intra-company transferees, technical experts, or executives. Work visas usually require approval from the Ministry of Labor and can take a few months to process. They are often granted for 2 years, renewable, or converted to permanent depending on the role.

- Investor Visa (Permanent Residence): Brazil offers a permanent visa (VIPER) for individuals who make a substantial investment in a Brazilian business. Under current rules, an immigrant investing at least BRL 500,000 (approximately USD 100k) in a new or existing Brazilian company can qualify for investor residency. In certain cases – such as startups in technology or ventures creating 10+ jobs – the threshold can be as low as BRL 150,000. The investor visa grants permanent residency, allowing you to live and work in Brazil, and can also include dependent family members. It is a popular route for entrepreneurs establishing manufacturing operations. The application involves presenting an investment plan to the immigration authorities. Once approved, you must actually remit the capital and register it (as noted earlier) to maintain the visa. The visa is conditional for a period (usually reviewed after 3 years) to ensure the investment and business activity materialize.

- Special Cases: Brazil also has visas for residents of Mercosur countries (under Mercosur agreements) that ease mobility, and it provides permanent residence to administrators or directors of companies that reach certain thresholds (often overlapping with the investor visa criteria). If a foreign employee will hold a position as an officer (e.g. general manager of the Brazilian subsidiary), they may obtain a leadership visa which also ties to the company’s investment and job creation.

In summary, plan the human resource strategy early: secure CPF numbers for all foreign principals (needed for any formal role in the company), decide who will relocate and under what status, and engage immigration counsel to handle work visa filings. Many foreign-led companies in Brazil use a combination of local hires and a few expat specialists, balancing expertise with local market know-how.

Read more:

Tax Reform in Brazil What Foreign Entrepreneurs Need to Know About the New VATTax Obligations in the Automotive Business

Tax Obligations in the Automotive Business

Brazil’s tax system is famously complex, with federal, state, and municipal taxes that can impact an automotive venture. It’s crucial to understand the major taxes – their rates, scope, and compliance requirements – to plan your cost structure and pricing. Below is a breakdown of key taxes relevant to automotive companies, followed by a summary table of rates.

Federal Taxes: Corporate Profits and Industrial Products

- Corporate Income Tax (IRPJ) and Social Contribution (CSLL): Brazilian companies pay income tax at the federal level. The standard corporate income tax (IRPJ) rate is 15%, plus a surtax of 10% on taxable income above BRL 240,000/year (approx. BRL 20,000 per month). Additionally, a social contribution on net profit (CSLL) of 9% is applied. For most industries (including automotive), these combine to an effective tax rate of 34% on profits. These taxes are typically assessed on quarterly or annual profits, under either the actual profit regime (Lucro Real) or a presumed profit regime (Lucro Presumido) for smaller companies. Large manufacturing businesses will almost invariably be under Lucro Real (actual income) calculation.

- Tax on Industrialized Products (IPI): IPI is a federal excise tax on manufactured goods, which applies to vehicles and auto parts produced in or imported into Brazil. For domestic manufacturers, IPI is charged at the time of sale of the product from the factory trade.gov. The IPI rate varies by product and is intended to be “selective” based on essentiality – basic necessities may have 0% IPI, whereas luxury goods have higher rates. Automobiles traditionally have IPI rates ranging roughly from 7% to 25% depending on engine size and fuel type (smaller, ethanol-fueled cars at the low end; larger gasoline SUVs at the high end)kluwertaxblog.com. (These rates have been adjusted occasionally – e.g., the government temporarily cut IPI by around 2 percentage points in 2022 to stimulate car saleskluwertaxblog.com.) As of late 2023, the average IPI on most cars is in the single digits to teens percent. Note that IPI on exports is exempt (to promote competitiveness abroad)trade.gov. IPI paid on inputs can be credited against IPI due on outputs (making it non-cumulative through the production chain). For imported vehicles or parts, IPI is collected at customs clearance, on top of import duty trade.gov.

- PIS and COFINS (Social Contributions on Gross Revenue): These are federal taxes levied on a company’s gross revenues. For most manufacturing companies under the non-cumulative regime, PIS is charged at 1.65% and COFINS at 7.6%, totaling 9.25% on gross receipts. These taxes work like value-added taxes (credits are allowed for PIS/COFINS paid on inputs, to offset the amounts due on sales). However, certain products or regimes have different rates. Of note, the automotive sector has some special PIS/COFINS treatments: for example, specific auto products might incur PIS at 2.0% and COFINS at 9.6%, slightly higher than standard (This was historically to offset other tax breaks given to automakers.) PIS/COFINS are also due on imports (with rates roughly 1.65% and 7.6% on the import’s CIF value + duty). Exports are zero-rated for PIS/COFINS, similar to IPI.

Withholding Taxes: If your Brazilian entity makes certain payments abroad – royalties, technical service fees, interest on loans, etc. – there may be withholding income tax (15% or 25%), CIDE tax (10% on some royalties/tech fees), and PIS/COFINS/ISS on imports of services. These are complex but worth mentioning for budgeting, especially if you will pay a parent company for technology or brand licenses.

Summary of Key Federal Taxes:

Tax What Typical Rate IRPJ (Corporate Income) Tax on corporate profits (federal) 15% + 10% surtax on high profits (≈25% top) CSLL (Net Profit Contribution) Additional profit tax to fund social security (federal) 9% (general rate) **Combined Income Taxes (IRPJ + CSLL) on profits 34% effective corporate tax rate PIS (Gross Revenue) Social Integration Program contribution on gross revenue (federal) 1.65% (non-cumulative regime)

0.65% (cumulative regime)COFINS (Gross Revenue) Social Security Financing contribution on gross revenue (federal) 7.6% (non-cumulative)

3% (cumulative regime)IPI (Industrial Products Tax) Excise tax on manufactured goods, including vehicles (federal) Varies by product; 0% up to ~30% normally.

Cars ~5–25% (depending on engine). Exports: 0% trade.gov.Note: PIS/COFINS rates shown are standard. Some auto-related products incur adjusted rates (e.g. 2%/9.6% as noted). Also, these taxes are generally recoverable via credits if you are in the non-cumulative regime (applicable to most medium-large companies).

State and Municipal Taxes: ICMS, ISS and Others

State and Municipal Taxes: ICMS, ISS and Others

- ICMS (Tax on Circulation of Goods and Services): ICMS is a state-level value-added tax applicable to the sale of goods (including vehicles and parts), intermunicipal and interstate transportation, communication services, and electricity. For an automotive business, ICMS will be one of the most significant taxes – it applies to vehicle sales, parts sales, and even imports. Each of Brazil’s 26 states (and the Federal District) sets its own ICMS rate for internal transactions, typically ranging from 17% to 20% on goods. For example, the state of São Paulo’s standard ICMS rate is 18%, while Rio de Janeiro’s is 20%. Some products deemed essential or part of the basic basket have lower rates (e.g. 7% or 12%), whereas others can have higher (up to 25% on certain luxury items or utilities). Automobiles usually fall in the standard rate category, though states occasionally offer reductions as incentives (more on incentives later).

ICMS works on a debit/credit system (non-cumulative) similar to VAT. Businesses get ICMS credits for the tax paid on inputs (e.g. raw materials, components) and then owe ICMS on the sale of finished products, offsetting the credits against liabilities. One complexity is interstate ICMS: when goods are sold from one state to another, the originating state charges a lower ICMS (7% or 12% depending on the destination region) and the destination state may charge an additional amount (to ensure a share of revenue). For instance, a car made in São Paulo sold to a dealership in Pernambuco might have 12% ICMS charged by São Paulo, and Pernambuco would later collect its portion when the car is sold to the end consumer. There is also a special 4% ICMS on interstate sales of imported goods (for products that were imported and then resold across states). – a rule to discourage simply routing imports through low-tax states.

Automotive companies must register with the state SEFAZ and comply with electronic invoicing (NF-e) and monthly ICMS filings. ICMS is typically the largest tax component of a vehicle’s price. It’s worth noting that ICMS incentives are a big bargaining tool – states have historically offered ICMS credits or deferrals to attract auto manufacturers to build plants, given this tax’s impact.

- ISS (Service Tax): Imposto Sobre Serviços is a municipal tax on services, with rates varying by city (within a federal cap of 5%). ISS would apply to services related to an automotive business – for example, if you operate repair workshops, design/engineering services, or even administrative services billed by one group entity to another. Manufacturing and sales of goods are not subject to ISS (those fall under ICMS), but if your company has a mixed activity (say, selling cars and also servicing them), the service component charges ISS. Each municipality sets its ISS rate usually between 2% and 5%. São Paulo city’s ISS for most services is 5%, whereas some smaller cities might have 2% to attract businesses. ISS is cumulative (no credit system), simply a percentage on the service fee. Businesses must register with the municipal tax department and issue service invoices for ISS purposes. In practice, many automotive investors won’t have a significant ISS burden unless they operate service centers or provide technical consulting, etc., but it’s important for completeness.

- Import Duties (II) and Related Import Taxes: For any automotive company that will import vehicles, parts, or machinery, import taxes are a vital consideration. Brazil is known for its high import tariffs to protect local industry. The Common External Tariff (CET) of Mercosur applies: for most finished automobiles, the import duty (Imposto de Importação, II) is 35% – the maximum rate Brazil agreed under WTO rules. This 35% tariff makes imported cars significantly pricier and is a key reason many automakers choose to produce locally. Auto parts have varied import duty rates (commonly in the 8%–18% range, depending on the part and whether it is produced domestically). In addition to II, imported goods incur IPI (as discussed), ICMS, and PIS/COFINS at the border – cumulatively, these can effectively double the cost of an import when all taxes are compounded ustr.gov. (The formula for import cost: CIF value + import duty; then IPI on top of that; then ICMS on top of CIF+II+IPI; plus PIS/COFINS on CIF+II.)

Automotive investors should also note Brazil’s trade agreements: imports from Mercosur countries (Argentina, Uruguay, Paraguay) generally enjoy duty-free status. There are also special trade accords (e.g., with Mexico for a quota of vehicles with reduced or zero duty). But imports from outside Mercosur will face the full tariffs. A recent development: electric vehicles were temporarily exempted from import duty to encourage green technology, but Brazil decided to reinstate a 35% import tax on EVs by 2026 (phasing it in gradually). Hybrid vehicles likewise are seeing their tax rates climb from 0-15% back up toward 35% over a few years. This policy signal suggests Brazil remains protective of local manufacturing, even for new technologies.

One relief measure is the “Ex-Tarifário” regime where import duty on certain capital goods or parts not produced in Brazil can be temporarily reduced to 0–2%. Many auto companies use this for specialized equipment. Also, if you import parts for manufacturing and then export the finished vehicles, Brazil offers drawback schemes that exempt or refund the import taxes to enhance export competitiveness.

- Minor Taxes: There are a few other charges to be aware of. The FGTS social contributions (separate from labor, but sometimes listed in tax context) and some municipal fees (like garbage collection, etc.) can apply. Also, Brazil has a Property Tax on Vehicles (IPVA) which consumers pay annually for owning cars – not a tax on the company unless you maintain a fleet. At the federal level, a possible tax reform is underway (as of 2025) that aims to simplify the system by merging some taxes (like PIS/COFINS into a VAT). Investors should stay tuned via official sources (Receita Federal updates) for changes in tax legislation.

Summary of Key State/Municipal Taxes:

Tax What Rate ICMS (State VAT) State tax on sale of goods, including vehicles/parts, and certain services (transport, etc.) 17%–20% typical internal rate (e.g. 18% in SP).

Interstate: 7% or 12% between states; 4% on interstate resale of imports.

(Higher or lower rates for specific items possible: e.g. luxury goods 25%, essential goods 12%.)ISS (Service Tax) Municipal tax on services (local) Varies by city, generally 2%–5% (5% max by law). Import Duty (II) Tariff on imported goods (federal, but listed for completeness) Common External Tariff varies. Vehicles: 35% (WTO bound max). Auto parts: often 8–18%.

Reduced to 0% within Mercosur origin.PIS/COFINS on Imports Social taxes on imports (federal) PIS 2.1% and COFINS 9.65% on CIF for most imports (effectively ~11.75%, as per current rules). These mirror domestic PIS/COFINS but are calculated in a particular way. Other local taxes e.g. Property taxes, fees E.g. IPTU (property tax) on real estate if you own a factory site (rate % of property value), varies by municipality.

IPVA (vehicle ownership tax) on company-owned vehicles ~4% of vehicle value annually (state levy).(Note: The above import duty and PIS/COFINS import rates are subject to specific HS codes; 35% applies to most passenger vehicles. Also, Brazil is enacting tax reforms that could change PIS/COFINS and ICMS into new taxes by 2026–27.)

Complying with tax obligations requires robust accounting. Companies must file federal and state tax returns monthly/quarterly, issue NF-e invoices for every sale (which calculate taxes in real time), and adhere to transfer pricing rules for any intercompany imports. It is highly recommended to use experienced tax professionals or consultants who understand the intricacies of Brazil’s tax legislation – especially for automakers, as special regimes (like credits under the Rota 2030 program) might apply.

Import & Export Procedures (Automotive Parts and Vehicles)

Import & Export Procedures (Automotive Parts and Vehicles)

If your business model involves importing vehicles, kits (CKDs), or automotive components into Brazil – or exporting from Brazil – it’s critical to understand the customs procedures and trade regulations:

- Import Licensing: Brazil operates an online trade system (SISCOMEX) through which all imports are registered trade.gov. Certain products are subject to an import license (Licença de Importação, LI), which can be “automatic” (granted upon declaration) or “non-automatic” (requiring prior approval from a government agency) ustr.gov. Automobiles and some auto parts fall under non-automatic licensing, as the government monitors them for compliance with safety and environmental standards. This means before shipping a vehicle to Brazil, the importer (your company or your distributor) must apply for an import license in SISCOMEX, which is reviewed by the Department of Foreign Trade and possibly by technical agencies. The lack of transparency and potential delays in non-automatic licenses have been a concern for foreign exporters ustr.gov – it’s important to plan for this in your supply chain timelines.

- Customs Clearance: Upon arrival of goods at port or airport, a Declaration of Import (DI) is filed in SISCOMEX. Brazil’s customs will check the paperwork (commercial invoice, packing list, bill of lading) and the import license if required. All taxes (II, IPI, PIS/COFINS, ICMS as applicable) must be paid for clearance trade.gov. Brazil uses a “yellow/red/green channel” system for inspections – automotive items often get detailed inspections (red channel) especially if new models or if subject to certification.

- Product Certification: Brazil mandates that vehicles and certain auto parts comply with local standards. New vehicles must have a Certificate of Adequacy (CAT) issued by DENATRAN (traffic authority) to be street-legal – usually this is handled by automakers homologating each model. Safety and environmental certifications are crucial. For example, tires, automotive glass, and components like seat belts require INMETRO certification to be imported/sold, ensuring they meet Brazilian technical standards. Emission standards (PROCONVE program) apply to vehicles – new cars must meet PROCONVE L7 (equivalent to Euro 6) as of 2022. An importer of vehicles needs to coordinate with the manufacturer to have the vehicle tested and approved for Brazilian regulations (or import only models already certified for Brazil). For used or second-hand machinery/vehicles: Brazil prohibits the import of used automobiles and auto parts for resale ustr.gov (only very limited cases like collectible vintage cars or moving personal vehicles are allowed). This is to protect the market from inflows of used cars.

- Export Procedures: Exporting from Brazil is generally easier in terms of restrictions – the government encourages exports by exempting taxes (no IPI, no ICMS, no PIS/COFINS on exports)trade.gov. An export declaration is filed in SISCOMEX and, if the goods have significant local taxes embedded, companies often use the “drawback” regime. Under Drawback, you can import parts tax-free if used in manufacturing goods for export, or get a refund/credit for taxes paid after you export. This is particularly valuable for automakers exporting vehicles or agrimachinery (many of Brazil’s tractor and agricultural equipment output is exported). The Manaus Free Zone (discussed later) also serves as an export platform with tax benefits. Note that certain exports might need licenses (e.g. hazardous products, or an export license for volume of vehicles due to trade agreements), but for cars and parts, usually it’s straightforward. Brazil does not levy export taxes on vehicles.

- Mercosur Considerations: Since Brazil is in Mercosur, a car produced in Brazil can enter Argentina, Paraguay, or Uruguay duty-free (as long as it meets a regional content requirement). There are periodic auto trade agreements with Argentina (to balance trade flows), so staying aware of Mercosur automotive industry accords is wise if you plan to export regionally. Mercosur also has FTAs that might reduce tariffs with other Latin American countries.

- Logistics and Ports: Most vehicle imports come through the ports of Santos (São Paulo) or Paraná (Paranaguá) for Asian/European vehicles, and via land from Mercosur neighbors. Ensure your customs broker in Brazil is experienced in handling automotive HS codes. The documentation must be precise – any error in declared values, weight, origin can cause clearance delays or fines. Brazil also charges a “Merchant Marine Fee” (25% on ocean freight) for imports ustr.gov, which is a cost to factor in.

Practical Tip: Engage a good freight forwarder and customs broker early. They will help obtain necessary licenses and ensure compliance with import quotas or regulations. For example, if importing any equipment or chemicals, check Brazil’s “Ex-Tarifário” lists and controlled substances lists. The paperwork for SISCOMEX registration (known as “RADAR” license for importers) should be completed as soon as your company is set up – this registration with Receita Federal gives your company the ability to import/export. It may have limits based on your net worth (there are tiers of import license allowing more or less trade volume). Planning these elements is key to avoid bottlenecks when your goods are at port.

Labor Laws, Hiring, and Compliance in Brazil

Brazil’s labor laws are known for being protective of employees, with significant mandatory benefits and regulations that employers must follow. Any foreign investor starting an automotive business – whether a manufacturing plant, a distribution office, or a services firm – needs to be aware of these obligations. Non-compliance can lead to labor lawsuits or fines, so this is a critical area for due diligence.

Employment Laws Overview

Employees in Brazil are covered by the Consolidation of Labor Laws (CLT) and the Federal Constitution provisions. In practice, this means all hires must have a formal employment contract (either indefinite or fixed-term) and be registered in the government system (using a digital “work card” registration). Key aspects of Brazilian labor law include:

- Working Hours: The standard workweek is 44 hours, typically 8 hours per day Monday to Friday and 4 hours on Saturday (though many companies distribute 44 hours over 5 days). Employees are entitled to at least one day off per week (usually Sunday). Overtime is permitted but limited – hours beyond the 44 per week or 8 per day generally must be paid with a 50% premium at minimum (100% on Sundays/holidays or as per union agreements). Some roles (like managers who are trusted employees, or employees on flexible remote regimes) might be overtime-exempt, but those are exceptions.

- Wages and Mandatory Bonuses: Brazil has a statutory minimum wage, which is adjusted annually (for 2024 it is BRL 1,320 and proposed BRL 1,412). In the automotive sector, often collective bargaining agreements set a higher “floor wage” for certain positions (e.g., an assembly line worker in São Paulo’s ABC region might have a contracted floor wage above the general minimum). A distinctive feature is the “13th month salary” (Christmas bonus) – one extra monthly salary paid each year, in two installments (50% by November 30 and 50% by December 20). This is mandatory for all employees. Additionally, if an employee takes their annual vacation (which is 30 days – see below), the employer must pay a vacation bonus of 1/3 of a month’s salary at that time.

- Paid Leave: Employees earn annual vacation of 30 calendar days after each 12 months of work. During vacation, they receive full pay plus that one-third bonus. Brazil also has generous maternity leave (120 days) and paternity leave (5 days) as minimums (some companies in special programs extend maternity to 180 days). There are around 12 public holidays per year (national and local) during which employees typically have off (if they work, overtime pay applies).

- Social Contributions (Employer Costs): Over and above the gross salary, employers must contribute to several funds. The biggest is FGTS (Fundo de Garantia do Tempo de Serviço) – the Severance Guarantee Fund. Employers deposit 8% of each employee’s monthly pay into a government account in the employee’s name. This fund accumulates and is intended to protect the employee in case of dismissal or other specific events (buying a house, retirement, etc.). There is also the INSS contribution (social security) – roughly 20% of payroll paid by the employer to fund public pensions and healthcare. Other payroll levies include contributions to apprenticeship fund (2%), workplace accident insurance (variable 1–3%), and several small contributions to industry training programs (SENAI, SESI etc., totaling a few percent). All in, the non-wage labor costs for employers can be on the order of +70–100% of the base salary for a typical manufacturing worker. This is a significant factor in Brazil’s labor cost structure.

- Unions and Collective Bargaining: The automotive industry in Brazil is heavily unionized. Unions are organized by sector and region (for example, metalworkers’ unions in each state). Collective Bargaining Agreements (CBAs) negotiated by unions and employer syndicates set many additional terms: job categories and wage scales, adjustment of salaries annually (often tied to inflation), benefits like meal tickets or health plans, working hour arrangements, and layoff processes. As an employer, you will likely need to affiliate with the local employers’ union for your industry, and follow the CBA provisions for your employees. Since 2017’s labor reform, CBAs can even modify certain legal provisions, but some core rights (like FGTS, 13th salary, etc.) cannot be reduced. Be prepared for annual negotiations and occasional strikes or stoppages – the auto sector unions in Brazil (such as the ABC Metalworkers in São Paulo) are very active.

- Compliance and Workplace Safety: Brazil has extensive labor regulations on health and safety, known as Normas Regulamentadoras (NRs). For an automotive factory, key NRs (regulatory standards) would include NR-12 (Machine Safety) – requiring proper guarding and emergency stops on machinery, NR-17 (Ergonomics) – addressing repetitive strain and proper workplace design, and others on handling chemicals, noise exposure, etc. Companies must form internal accident prevention commissions (CIPA) if they have more than 20 employees, conduct periodic safety training (like NR-5, NR-6 for PPE usage), and provide mandated protective equipment. Inspections by the Ministry of Labor can occur, and non-compliance can result in fines or even embargo of operations until issues are fixed. Environmental and worker safety compliance is taken seriously – especially in manufacturing zones, authorities perform audits.

- Termination Rules: Firing employees in Brazil (especially in manufacturing) incurs costs. If you dismiss an employee without cause, you must pay, in addition to their accrued rights (pro-rated salary, vacation, 13th), a fine equal to 40% of the FGTS balance that you have deposited for them. This is essentially a severance penalty paid to the employee, intended to compensate for job loss. For example, if over time you deposited BRL 10,000 into an employee’s FGTS, you pay an extra BRL 4,000 at termination to them. Notice period also applies – typically 30 days’ notice or pay in lieu of notice (and an additional 3 days per year of service, up to 90 days). Collective dismissals (laying off many workers) no longer require union or government consent explicitly (a change since labor reform), but in practice, many large firms still negotiate packages with unions to mitigate unrest. If an employee quits or is fired for cause (limited severe reasons like misconduct), the severance is much lower (no FGTS fine, etc.). Brazil also allows employer and employee to mutually agree on termination, in which case the fine and notice can be halved. All these calculations and payments are typically done at a mandatory exit meeting with the employee, and any disputes can be taken to labor court.

Given these rules, companies should budget labor costs carefully and consider strategies like outsourcing non-core functions (e.g. security, cleaning, canteen services) to specialized firms – although Brazil has regulations on outsourcing (allowed for any activity as of reform, but the contractor must also follow labor laws). Many foreign investors are surprised by the high effective cost of a Brazilian employee when benefits are included, but they also find that a stable, well-compensated workforce contributes to lower turnover and better productivity in the long run.

Practical Labor Tips:

- Use Experienced HR and Legal Advisors: Setting up payroll and HR in Brazil is not trivial – you must comply with eSocial (the government’s integrated labor reporting system) and routinely update for changes. Engage a knowledgeable HR manager or a payroll outsourcing service with experience in your industry. Consult labor lawyers especially when drafting employment contracts for high-level staff or implementing variable bonus plans, to align with Brazilian law.

- Engage with Unions Positively: Rather than viewing unions as adversaries, involve them early when starting operations. For instance, if building a new plant, community and union leaders will want to know about job opportunities and working conditions. Building a constructive relationship can ease future negotiations. Brazil’s unions often demand training programs or improvements for workers – aligning on these can improve your company’s local reputation.

- Compliance Calendar: Mark the mandatory annual events – e.g. Annual salary adjustment date (often date of CBA renewal), profit-sharing agreement (PLR) if you choose to have one (many companies negotiate a productivity-based bonus with employees yearly, which, if done via union accord, is tax-advantaged), CIPA elections (work safety committee elections yearly), etc. By staying ahead of these, you avoid fines or last-minute scrambles.

In summary, labor is a regulated but manageable aspect of doing business in Brazil. The country’s workforce in the automotive sector is quite skilled – Brazil has been manufacturing vehicles for decades, so engineers and technicians are readily available. Just ensure compliance and fair practices, and you can tap into this human capital effectively.

Environmental and Safety Regulations in the Automotive Sector

Brazil has robust environmental laws and regulations that particularly affect industrial ventures like vehicle manufacturing, assembly plants, or even large auto repair facilities. Any foreign investor in the automotive industry must plan for environmental licensing, pollution control, and product compliance with safety and environmental standards.

Environmental Licensing for Facilities

If you are setting up a factory or any facility that has a potential environmental impact (which includes most automotive plants, paint shops, parts manufacturing, etc.), Brazil’s National Environmental Policy requires you to go through an environmental licensing process. As mentioned earlier, this process typically involves three stages:

- Preliminary License (Licença Prévia, LP): Granted at the project planning stage, after approval of an environmental impact assessment (if required). It confirms the project’s environmental viability and lays out basic conditions. For example, when planning a new assembly plant, you’d submit studies on air emissions, effluent, local traffic, etc., and get an LP that approves the site and technology in principle.

- Installation License (LI): This license allows construction to commence. You obtain it by meeting the conditions of the LP (e.g., having certain mitigation plans in place). The LI might specify how you must build environmental control systems – e.g., install effluent treatment, chimneys with filters, noise barriers.

- Operation License (LO): Finally, before starting production, you obtain the LO, which authorizes the facility to operate under specific environmental constraints (emission limits, monitoring requirements). LOs are typically valid for a few years and must be renewed.

These licenses are issued by the environmental authority with jurisdiction. In most cases, that will be the state environmental agency (for example, CETESB in São Paulo, or SEDEMA in Minas Gerais), because impacts are within one state. If a project’s impact spans multiple states or is in a sensitive federal area, IBAMA (the federal environmental agency) might be the licensing authority.

Automotive plants usually involve significant environmental aspects: use of paints and solvents (air emissions, hazardous waste), wastewater from processes, energy consumption, etc. Brazilian regulations will require mitigation – e.g., a paint shop will need to have VOC emission controls and proper disposal of sludge; any storage of fuel or oil must have containment; water usage might require a grant. Ensure you hire environmental consultants to navigate the EIA/RIMA (Environmental Impact Report) if applicable, and to liaise with government. The good news is states like São Paulo have well-defined processes, and if you comply, licensing is achievable without undue delay. Non-compliance, however, can lead to hefty fines or even operations being suspended by environmental inspectors.

Brazil is also intensifying enforcement of waste management. Under the National Solid Waste Policy, manufacturers may have responsibilities for reverse logistics – for example, ensuring proper disposal or recycling of certain automotive wastes (tires, batteries, oil). Already, tire manufacturers and importers must maintain programs to collect and dispose of used tires. As an automotive investor, you should be aware of any extended producer responsibility for your products.

Emissions and Vehicle Environmental Standards

Brazil’s automotive emissions standards (PROCONVE for vehicles, PROMOT for motorcycles) are akin to European norms, with some lag. Currently:

- Light Vehicles: PROCONVE L7 came into effect in 2022, aligning with Euro 6 emission limits. PROCONVE L8 is scheduled to tighten limits further by 2025, bringing standards close to Euro 6c. These regulations limit pollutants like NOx, HC, CO, and particulate matter from tailpipes. Automakers must test new models at accredited labs in Brazil and obtain certification from IBAMA/DENATRAN before selling. If you’re manufacturing or importing vehicles, compliance with PROCONVE is mandatory. It affects engine technology (e.g., requiring electronic controls, catalytic converters of certain efficiency, and for diesel, possibly DPF filters for heavy vehicles under P8/Euro VI).

- Heavy Vehicles: For trucks and buses, PROCONVE P8 (equivalent to Euro VI) started for new models in 2022 and all productions in 2023. This required significant upgrades in diesel after-treatment (like SCR systems). Any foreign truck/bus makers must meet these.

- Fuel and Flex Fuel: A unique aspect in Brazil is the prevalence of ethanol (E100) and flex-fuel vehicles. About 90% of new cars are flex-fuel (can run on ethanol or gasoline) en.wikipedia.org. Emission standards account for ethanol’s different profile. Brazil encourages biofuels to reduce CO₂ – there’s even talk of future hybrid vehicles running on ethanol as a clean solution en.wikipedia.org. Investors in the auto sector might find an accommodating environment for alternative fuel projects, but they must coordinate with regulators for any new tech approval.

- Noise and Safety Standards: Apart from emissions, vehicles in Brazil must meet safety regulations issued by CONTRAN. This includes mandatory features like dual front airbags and ABS brakes, which have been required on all new cars since 2014. There are also requirements for child seat anchors, lighting, tires standards, etc. These are largely in line with UN regulations (Brazil has adopted some UN vehicle regs). If you are introducing a new model, you need to get it homologated for all these standards. Often, partnering with a local engineering firm or hiring compliance experts is necessary to navigate tests for crash safety (if applicable), noise levels, and so on.

In essence, any product you manufacture or import must be homologated for Brazil’s market. Plan for 6-12 months of lead time for testing and certification before a vehicle model can launch.

Workplace Safety and Environmental Compliance Onsite

While mentioned partly in Labor, it’s worth reiterating from an EHS (Environment, Health, Safety) perspective: an automotive factory must comply with workplace safety standards. The Regulatory Norms (NR) cover everything from machine operation training (NR-12 requires detailed risk analysis and training on each equipment) to use of PPE, to ergonomics in repetitive tasks (critical in assembly lines to prevent injuries). Brazil also requires Fire Department approvals for facilities (ensuring you have detectors, alarms, sprinklers as per local fire code). Regular drills and proper signage (in Portuguese) are mandatory.

Environmental monitoring will be ongoing. Most licenses will oblige you to, for example, monitor air emissions (e.g. annual boiler stack tests), treat wastewater and submit analysis reports, properly store hazardous waste and ship it to licensed disposers, etc. Communities near factories are increasingly vigilant, and Brazil’s Public Prosecutors can act on environmental complaints. Therefore, demonstrating a strong corporate social responsibility – e.g., controlling any paint odors, supporting recycling, avoiding any spills – will not only keep you compliant but also earn goodwill.

Brazil has stiff penalties for pollution – including criminal liability for company officers in cases of serious environmental damage. So environmental compliance is not just a bureaucratic step, but a crucial part of sustainable operation.

In summary, environmental and safety regulation in Brazil is comprehensive but in line with global standards. The automotive sector, given its potential impacts, is under a microscope – but if you implement international best practices in EHS, you’ll likely meet Brazilian requirements. Always engage with local environmental consultants and attorneys when planning a new project, and factor in the time and cost for environmental licenses in your project timeline (it can take several months to over a year for large projects to get all approvals).

Tax Incentives and Special Programs for Automotive Investors

To spur industrial development, both federal and state governments in Brazil offer tax incentives and financing benefits – many tailored to the automotive sector. Foreign investors should explore these, as they can significantly improve the business case. Here are some key incentives and programs:

Federal Incentives: Rota 2030 Program and Others

Rota 2030 – Mobility & Logistics is the flagship federal program (successor to the earlier Inovar-Auto) designed to encourage technological innovation and efficiency in the auto industry. Enacted by Law 13.755/2018, Rota 2030 provides a series of benefits:

- Tax Credits for R&D: Automakers and auto parts companies that invest in research and development activities in Brazil can receive income tax credits. Typically, a percentage of qualified R&D expenditure can be taken as a credit against IRPJ/CSLL. There is a base credit (up to 10-12% of the R&D spend) and an additional bonus credit (up to 5-7%) for strategic areas like powertrain efficiency or safety improvementscdn.ihs.com. In practice, major car manufacturers have saved tens of millions by utilizing these credits – it incentivizes keeping engineering work in Brazil.

- IPI Reduction for Efficient Vehicles: Rota 2030 set up new efficiency and safety targets. Vehicles that meet certain fuel efficiency or safety benchmarks enjoy IPI tax rate reductions (e.g., a car model meeting an aggressive CO₂ g/km target might get 2% off its IPI rate). This effectively rewards manufacturers of hybrid, electric, or very efficient ethanol cars by lowering the excise tax passed to consumers, making those models more competitive.

- Import Tax Exemptions for High-Tech Auto Parts: Another benefit under Rota 2030 is exemption of import duties on auto parts not produced in Brazil, when used in local production. A list of eligible components is maintained; it allows manufacturers to import certain advanced parts (for example, an EV battery or a turbocharger assembly) at 0% II instead of the normal tariff, provided that part isn’t available from domestic suppliers. This reduces cost for innovative vehicles and encourages localization stepwise (bringing assembly first, then maybe component manufacturing later as volume grows).

- Inovar-Auto residual benefits: Although the Inovar-Auto program (2013-2017) ended (it had imposed a 30% IPI surcharge on imports and given credits for local content and R&D), some vehicles that were approved under its regime carried benefits through 2020. Now Rota 2030 fully replaces it with a more WTO-compliant structure (focus on R&D incentive rather than import penalties).

- Electric and Alternative Fuel Incentives: The Brazilian government signaled support for electrification by initially waiving import duty on pure electric vehicles (as mentioned, that waiver is being rolled back). However, electric vehicles are exempt from IPI (which is normally 7-25% on cars) at the federal level. Hybrids have reduced IPI depending on engine size. These tax breaks mean if you are investing in assembly or import of EVs, you benefit from a lighter tax burden, at least for now. Additionally, certain state incentives (discussed below) stack on top for EVs.

- Sudene/Sudam Regional Incentives: If you establish manufacturing in the Northeast or North of Brazil, companies can apply for status with Sudene (Northeast Development Authority) or Sudam (Amazon Development Authority). Qualifying industrial projects can get 75% reduction in IRPJ for 10 years, and other financing perks. For example, a car assembly plant in the state of Pernambuco (NE) or Pará (North) might enjoy substantially lower profit taxes as a stimulus to develop those regions. Many automakers in newer factories (like Jeep in Pernambuco, or a potential EV factory in Bahia) negotiate these benefits.

- BNDES Financing: Brazil’s state development bank BNDES often provides subsidized loans or credit lines for automotive investments, especially those that foster new technology or local supply chain. Historically, automakers have tapped BNDES for factory expansion loans at rates below market. For suppliers, there are programs like BNDES Pro-Auto focusing on automotive parts competitiveness.

State and Local Incentives: ICMS Reductions and Infrastructure SupportStates compete vigorously for automotive investments, as a car plant brings jobs and ancillary businesses. They typically use ICMS tax incentives as the carrot:- ICMS Deferral/Reduction: A common incentive is offering a “presumed credit” or partial ICMS exemption on the sale of vehicles manufactured in the state. For instance, the state of Goiás attracted manufacturers by effectively charging a much lower ICMS effective rate for a period (via access to credit equal to a percentage of the tax). Pernambuco (which hosts a Jeep assembly plant) provided a 95% presumed ICMS credit on output, meaning only 5% of the normal tax was effectively paid www2.gwu.edu. This drastically boosts the manufacturer’s margins or allows lower pricing. Similarly, many states waive ICMS on imported machinery and parts for use in the factory setup www2.gwu.edu.

- Infrastructure and Training: States may also invest in local infrastructure (roads, utilities to the site) and workforce training in exchange for the company’s commitment. For example, when a factory is built, the state might build new highway access or give land at a discounted price in an industrial park. They might partner with SENAI (industrial training service) to set up a training center for automotive trades to supply skilled labor. The Manaus Free Trade Zone (discussed next) is a unique case where federal and state benefits combine.

- ISS and Property Tax breaks: Municipalities (city governments) often exempt or reduce ISS (service tax) and IPTU (property tax) for a number of years for new industries. If you set up a facility in a smaller city, the city may say: “No ISS on construction services for your plant, and 0% property tax for 5 years” as part of the incentive package. Always negotiate with both state and city authorities; usually they formalize incentives via law decrees once you commit.

Manaus Free Trade Zone (ZFM)

No discussion of incentives is complete without Manaus Free Trade Zone in Amazonas state. Manaus offers extraordinary incentives, but with certain limitations:

The Manaus Free Trade Zone (ZFM) was created to promote industry in the Amazon region. Companies in the Manaus Industrial Pole enjoy federal tax exemptions on imports and industrial products, plus state ICMS benefits. For example:

- Import Duty: Goods imported into Manaus for use in manufacturing can be imported free of duty, or with up to 88% reduction for raw materials that will be used in making products.

- IPI: Products manufactured in Manaus are exempt from IPI when sold domestically. Also, any raw materials from elsewhere in Brazil that are brought into Manaus are exempt from IPI. This is a huge advantage – essentially no excise tax on your finished goods.

- PIS/COFINS: Sales within Manaus or between Manaus-based companies are exempt from PIS and COFINS.

- ICMS: The state of Amazonas provides extremely generous ICMS credits/deferrals. Often effectively zero ICMS is paid on output from Manaus destined to other states, because they treat it as an export from the Free Trade Zone. (Usually, the interstate buyer then pays something equivalent, but there are financial tricks to make it attractive.)

However, there is a major catch: by law, passenger cars are excluded from Manaus benefits. When the zone was set up, the government did not want to undercut the auto industry in the South/Southeast, so it disallowed using Manaus as a base to make regular cars tax-free. This is why Manaus became a hub mainly for two-wheelers (motorcycles) and electronics. Indeed, virtually all major motorcycle brands (Honda, Yamaha, Harley) manufacture in Manaus, enjoying the benefits, while no mass-market car plants are there. That said, Manaus does host production of some special-purpose vehicles (like all-terrain vehicles, boats) and auto parts which may qualify for incentives. If your business is making, say, engines or electronics, Manaus could be viable.

Manaus incentives are currently slated to exist until at least 2073 (it has been extended by legislation). The caveat for a foreign investor is that operating in Manaus can have higher logistics costs (it’s remote, goods to the big consumer markets in São Paulo/Rio have to travel a long way) and there are bureaucracy and oversight from SUFRAMA (the zone authority) to ensure you meet your approved project parameters. But the tax saving is so substantial that many supply chain calculations tilt in favor of Manaus, especially for export-oriented production (since you can import components duty-free, assemble, and export with no taxes – a true free zone).

Local Content and Other Programs

Brazil currently doesn’t enforce strict local content requirements in auto manufacturing (Inovar-Auto had such requirements, but Rota 2030 removed the local content rule to comply with WTO). Nevertheless, to benefit from certain incentives, there might be soft requirements: e.g. to get the full R&D credit in Rota 2030, you must meet some efficiency targets, which indirectly pushes you to invest locally.

Additionally, keep an eye on state development programs. Some states have innovation funds or will co-invest in new technology ventures (through their development agencies). ApexBrasil and InvestSP (for São Paulo) can help navigate these, as they often act as a bridge between investors and government incentive programs.

Summary of Major Incentives:

- Rota 2030: Tax credits on R&D (up to ~12-17% of spend), IPI reduction of 1–2% for high-efficiency models, import duty exemptions on certain parts.

- Regional Sudene/Sudam: 75% income tax reduction for 10 years for projects in the NE/North (upon application approval).

- State ICMS deals: e.g., Goiás’s Fomentar program, Pernambuco’s Prodeauto, São Paulo’s IncentivAuto (a newer program that offers deferral of ICMS for automakers that invest above certain amounts). These are specific, but each new investment can negotiate its own terms with state government.

- Manaus FTZ: No Import tax, no IPI, no PIS/COFINS, heavily reduced ICMS for eligible industries in Manaus (excludes passenger cars).

- Export Incentives: Drawback (import tax rebates) and Reintegra (a program that refunds a portion of export value to exporters, as a way to refund embedded taxes – the rate changes, around 0.5% to 3% historically). Automotive exporters often utilize Reintegra when available.

- Financing: Special credit from BNDES for toolings, capacity expansion, or from regional funds (e.g., FNE for Northeast).

In all cases, engage with Brazil’s investment promotion agencies (ApexBrasil, state investment offices) early. They can help identify applicable incentives and even assist in incentive negotiations. Foreign investors sometimes are not aware they need to formally apply or commit to certain performance (like job creation, investment amount) to lock in incentives. Ensure your project plan aligns with what incentives require (for example, to get Sudene, you must be in an approved industry and location and submit a plan for approval before starting operations).

Bureaucratic Challenges and Practical Tips for Foreign Investors

Brazil offers immense opportunity, but new investors often face a steep learning curve with bureaucracy. As we conclude, let’s highlight some challenges you should be prepared for, and pragmatic tips to succeed:

Key Bureaucratic Hurdles:

- Complex Regulations and Multiple Agencies: As evident, you will deal with federal bodies (Receita Federal, Banco Central, IBAMA, Ministries), state bodies (Junta Comercial, SEFAZ, environmental agencies), and municipal offices. Procedures are not fully unified, and rules can change. Keeping track of obligations (tax filings, license renewals, visa renewals, etc.) requires diligence.

- Heavy Documentation: From notarized translations of documents to detailed forms for every employee hire, paperwork is part of the game. Brazil still has remnants of a formalistic culture – e.g., every invoice needs specific wording and coding; every import needs myriad details. The language barrier is real: all official forms and communication are in Portuguese. So, having bilingual staff or translators is essential.

- Lengthy Timelines: While improvements are ongoing, some processes are slow. For instance, getting a construction permit for a factory can take months. Judicial processes (if you have any legal disputes) can drag on for years due to an overloaded court system. Patience and proper planning are virtues; build buffer time into your project schedules.

- Tax Complexity and Changes: The tax burden in Brazil is not just high, but the system is notoriously intricate. Even local companies struggle with the sheer number of tax rules and cascading systems. Moreover, tax laws change frequently (sometimes annually with budget laws). The compliance cost – in terms of accounting hours – is one of the highest in the world. For a foreign investor, this can be overwhelming without local expert help.

- Labor Litigation Culture: Brazil has had a very active labor courts system. Employees have been prone to sue for any perceived discrepancies (unpaid overtime, etc.). Though recent reforms have tempered this (employees now have some risk of paying the employer’s legal fees if their lawsuit is entirely baseless, which reduced frivolous claims), you should expect that at some point an ex-employee might file a claim. It’s often simply “cost of doing business” – many are settled or are low-value – but it’s something to be aware of.

Practical Tips for Investors:

- Hire Local Expertise: This cannot be stressed enough. Engaging a reputable local law firm (for corporate, labor, and tax matters) and a good accounting firm will save you headaches. They will ensure your company books are correct, your contracts follow Brazilian law (contracts in Brazil can have peculiar required clauses), and your rights are protected. When dealing with government agencies, having someone who knows the procedures (e.g., a despachante for car registrations or a broker for customs) smooths the process.

- Use an Experienced Import/Export Partner: If your business depends on importing parts or exporting vehicles, consider using the services of a trading company (comissária) or logistics provider experienced in automotive. They can handle paperwork and compliance for you at a fee, which is worthwhile to avoid shipment delays at customs due to mistakes.

- Leverage Government Support: Agencies like ApexBrasil (national) and state investment promotion boards (like InvestSP, Invest Minas, etc.) are there to help foreign investors. They can provide valuable market data, introductions to local authorities, and sometimes troubleshooting if you hit a bureaucratic snag. For example, ApexBrasil can facilitate meetings with ANFAVEA or local suppliers, and state agencies often have “fast-track” contacts in environmental or licensing departments to assist major investors.

- Plan for “Brazil Cost” in Timeline and Budget: The term “Custo Brasil” refers to the added cost of doing business due to inefficiencies. Build a contingency in your budget for the unexpected – be it an extra security guard needed due to some regulation, or a delay in getting equipment through customs that incurs storage fees. Having a financial cushion and not cutting it too fine on timing will help you weather these common hiccups.

- Stay Compliant and Ethical: It may be tempting to circumvent some bureaucracy through “informal” means, but note that Brazil has strong anti-corruption laws (the Clean Company Act) and an active enforcement climate. The old days of widespread graft are waning; today, companies are expected to have compliance programs. Especially as a foreign investor, maintain a high standard of corporate compliance – do proper import valuation (under-invoicing imports to evade duty is illegal), do not engage in questionable payments, and ensure transparency. This not only keeps you out of legal trouble but builds a positive reputation. Many multinationals in Brazil have shown that you can succeed with integrity and by pushing for systemic improvements.

- Networking and Local Insight: Join industry groups like ANFAVEA (if an automaker) or Sindipeças (auto parts manufacturers’ association), and chambers of commerce (like the American Chamber, European Chamber in Brazil). These networks provide updates on regulatory changes, collective advocacy (e.g., lobbying for tax reform or better infrastructure), and a community of peers to learn from. Local partners or distributors, if you have them, can also offer cultural insight – Brazilians value personal relationships in business, so investing time in face-to-face meetings, understanding local consumer preferences (what Brazilians want in a car, for instance), and even learning some Portuguese will pay dividends.

- Keep Abreast of Reforms: Brazil in 2025 is undergoing reforms – notably a Tax Reform and potentially an Administrative Reform – aimed at simplifying taxes (creating a VAT to replace ICMS, IPI, PIS/COFINS) and reducing public bureaucracy. These could fundamentally change some of the processes mentioned. So, stay informed via official sources (Receita Federal releases, Ministry of Economy announcements) or your advisory firms about new laws. Adapting quickly can sometimes open new advantages (e.g., a simpler tax might reduce compliance cost).

Despite the challenges, countless foreign companies have prospered in Brazil’s automotive sector – from big automakers that have been here since the 1950s to specialized parts makers who arrived more recently. The keys are patience, preparation, and partnership with good local allies. If you approach Brazil with a long-term view and commit to understanding its norms, the reward is access to a huge market and the chance to be part of a dynamic industry shaping mobility in Latin America’s leading economy.

Conclusion

Entering Brazil’s automotive industry as a foreign investor can seem daunting, given the web of legal, tax, and regulatory requirements. However, with thorough preparation and the right support, it is entirely feasible and can be highly rewarding. Brazil offers a combination of strong demand, a diversified industrial base, and government incentives that few emerging markets can match. By understanding the landscape – from the market opportunities (a large flex-fuel vehicle market now transitioning toward hybrids and EVs) to the legal must-dos (choosing the correct entity, registering your business, obtaining visas), from managing tax burdens (and utilizing incentives where available) to ensuring labor and environmental compliance – you position your venture for success.

In summary, here is a quick recap in the form of a final checklist for foreign investors planning to start an automotive business in Brazil:

- Market Entry & Strategy: Research and confirm your market niche (e.g., manufacturing vs. importing, passenger cars vs. parts). Connect with ApexBrasil or industry associations for data. Plan your entry location (established auto hubs in São Paulo/Minas vs. incentivized locations like Northeast).

- Company Setup: Form your Brazilian entity (likely Ltda), get CNPJ, local bank account, and necessary registrations. Don’t forget to register foreign capital with the Central Bankapexbrasil.com.br.

- Legal Compliance: Appoint a local legal representative if needed; secure any required visas for expats (investor visa if you qualify by capital, or work visas for key personnel). Check restricted sectors (none for auto manufacturing, but be mindful if your business touches on something like defense vehicles or media).

- Tax Planning: Consult a tax advisor on the optimal tax regime (Lucro Real vs Presumido), avail any tax incentives (Rota 2030 credits, Sudene if applicable, state ICMS incentives), and set up proper accounting for PIS/COFINS credits, ICMS credits, etc. Implement software for Brazil’s electronic invoicing requirements.

- Supply Chain & Trade: Obtain RADAR permit for imports, line up customs brokers, and ensure product homologation (get your vehicle or part certifications in order). If exporting, look into drawback and keep documentation for tax-free export sales.

- Site & Environmental: If building a facility, start environmental licensing early – hire an environmental consultant to manage EIA and license applications. Engage with state/local authorities on infrastructure needs (utility hookups, road access).

- Workforce & HR: Hire a seasoned HR manager to implement CLT correctly – from proper timekeeping (for overtime) to depositing FGTS monthly. Register with labor authorities and a workers’ union as required. Develop a good compensation and benefits scheme that meets both legal and competitive standards (many auto firms offer additional health insurance, meal vouchers, transport for employees, etc., by convention or CBA).

- Operations & Continuous Compliance: Mark your calendar with all compliance deadlines – tax filings, license renewals, annual corporate filings, etc. Build a relationship with a local bank and possibly public entities (for example, BNDES if you’ll seek financing). Prioritize compliance (labor, tax, environmental) to avoid fines – Brazil does inspect and enforce, and being proactive is easier than fixing violations after the fact.

Entering a new country is never plug-and-play, but Brazil provides a clear framework. By following this guide and leveraging official resources (check out Receita Federal’s guides, MDIC’s publications, and seek counsel from Brazilian legal/tax experts), you will be well-equipped to navigate the Brazilian automotive sector’s terrain. Many foreign investors before you have successfully made Brazil their second home – with the right approach, your company can be next to ride the growth of Brazil’s automotive market.

0 Comments