Introduction

Understanding Brazil’s corporate tax system is crucial for foreign investors entering the market. The main corporate income tax, IRPJ (Imposto de Renda de Pessoa Jurídica), applies to all Brazilian companies and can significantly affect profitability. In 2026, new rules and broader tax reforms will reshape the tax landscape. For example, Brazil has introduced a new dual VAT regime (CBS and IBS) phased in from 2026. At the same time, IRPJ remains 15% on taxable profits, with an additional 10% surcharge on quarterly profits above BRL 60,000. This blog explains IRPJ for foreign companies in Brazil in 2026 and advises on strategic planning.

What Is IRPJ in Brazil?

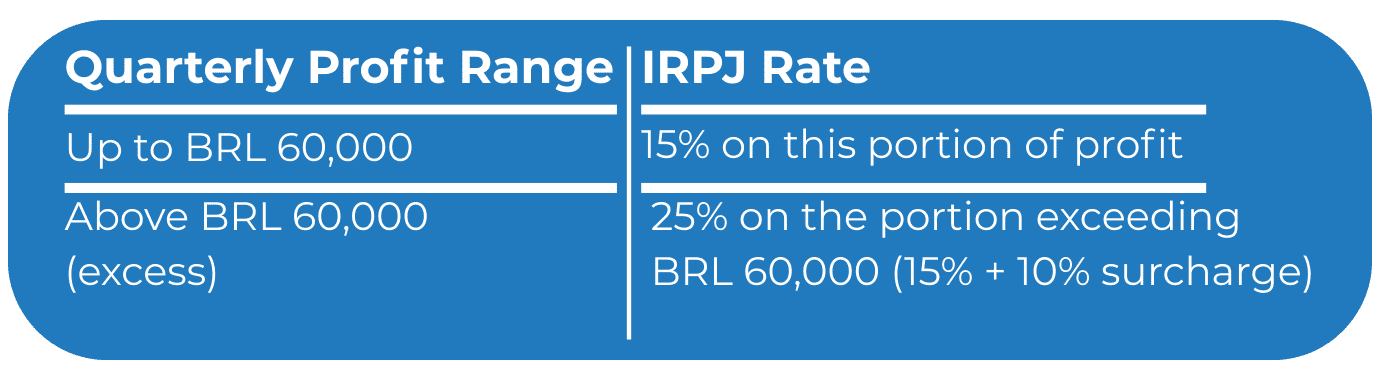

IRPJ is Brazil’s Corporate Income Tax, levied on a company’s net profit. The standard rate is 15% on taxable income. Once a company’s taxable profit in a quarter exceeds BRL 60,000, an extra 10% surcharge (totaling 25%) applies to the excess. For example, an annual profit of BRL 300,000 faces 15% on the first BRL 240,000 and 25% on the remaining BRL 60,000. In addition, the Social Contribution on Net Profit (CSLL) is generally around 9%, bringing the combined effective rate close to 34%.

The table below summarizes the IRPJ rate breakdown:

Foreign companies should also note that from 2026 certain tax incentives and benefits are being reduced. A new law (Supplementary Law No. 224/2025) cuts many federal tax incentives by 10%, effective January 1, 2026. This includes some IRPJ exemptions used by companies in development zones or special regimes. In practice, if your subsidiary enjoyed any IRPJ credit or exemption, expect the benefit to be 90% of its former value starting in 2026.

Tax Regimes Available in Brazil

Brazil offers three main tax regimes for corporate tax purposes:

-

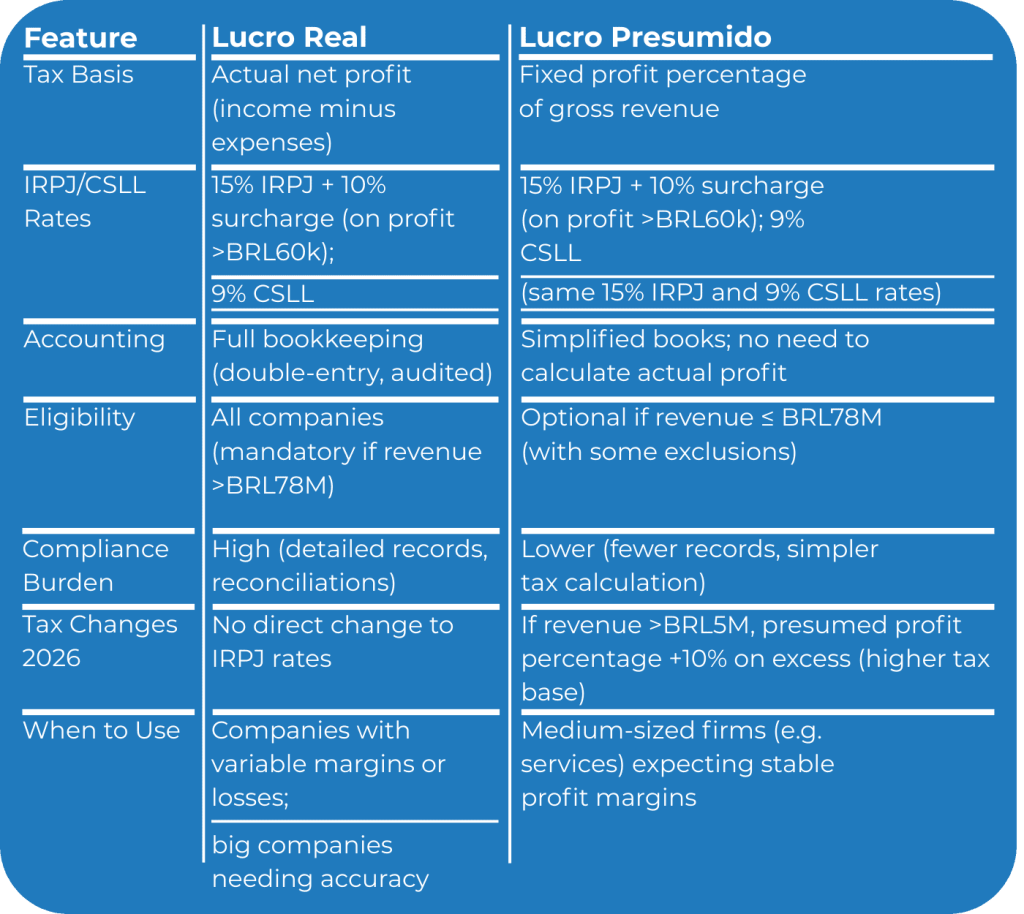

Lucro Real (Actual Profit): Companies calculate IRPJ/CSLL based on their actual net profit, using full double-entry accounting. This regime is mandatory for large companies (e.g. gross revenue over BRL 78 million per year) or certain industries (financial institutions, etc.). Profits and losses are accurately tracked, and losses can be carried forward. This requires detailed bookkeeping and periodic audit. The effective tax rate (15% + surcharge + CSLL) applies to the true profit.

-

Lucro Presumido (Presumed Profit): A simplified regime where taxable income is a fixed percentage of gross revenue (the percentage depends on the activity, e.g. 8% for commerce, 32% for some services). IRPJ (15% + surcharge) and CSLL (9%) are then applied to that presumed profit. Lucro Presumido is allowed for companies with revenue up to BRL 78 million per year. It involves simpler accounting but can be less accurate – a company may pay tax on an assumed profit even if actual profit is lower.

Starting in 2026, a new rule affects Lucro Presumido: companies with annual revenue above BRL 5 million must increase their presumed profit percentage by 10% on the portion exceeding BRL 5 million. In other words, a service company generating BRL 6 million would pay IRPJ/CSLL on a higher profit base for that extra BRL 1 million, raising its tax burden.

-

Simples Nacional: A unified simplified tax regime for very small businesses (annual revenue up to ~BRL 4.8 million). Simples consolidates many federal, state and municipal taxes into one monthly payment. However, it generally does not apply to companies with foreign shareholders or large corporate groups. Foreign-owned entities are usually ineligible, so most foreign investors choose between Lucro Real and Lucro Presumido.

The comparison table below highlights key differences between Lucro Real and Lucro Presumido:

Choosing the right regime is critical. A foreign company should model its profits under both regimes to see which yields lower tax. In general, stable-margin businesses often prefer Lucro Presumido for simplicity, but the 2026 rule on the BRL 5M threshold may tilt some large Presumed companies back to Lucro Real.

How IRPJ Affects Foreign Companies

Foreign investors need to understand how Brazil’s IRPJ rules apply to cross-border operations and structures:

-

Permanent Establishment (PE) Risk: If a foreign company does business in Brazil (through salespeople, projects, or services) without a local subsidiary, the tax authorities may deem it to have a Brazilian permanent establishment. A PE is subject to IRPJ on income attributable to that activity. To avoid unexpected taxation, many foreign investors form a local legal entity (branch or subsidiary) that is clearly registered and complies with Brazilian law.

-

Local Subsidiary vs. Branch: A subsidiary is a separate Brazilian company (with its own CNPJ tax ID). It pays IRPJ on its profits, and any distributions (like dividends) to the foreign parent may incur Brazilian withholding tax. A branch (filial) of the foreign company is not a separate legal entity, but it files Brazilian taxes on the branch’s profits. Branches still pay IRPJ and CSLL in Brazil; the main difference is how corporate formalities and repatriation work. Both structures require Brazilian accounting, but a subsidiary offers clearer separation of liability and is usually preferred by foreign investors.

-

Transfer Pricing: Brazil has rigorous transfer pricing (TP) rules to prevent profit shifting. Transactions between the Brazilian entity and related foreign parties (e.g. sales, loans, services) must use prices within specified arm’s-length bands. Non-compliance can lead to IRPJ adjustments and penalties. Foreign companies should document their intercompany pricing strategy according to Brazil’s rules (which differ from OECD rules) and review it regularly.

-

Profit Remittance and Dividend Taxation: Before 2026, Brazil generally did not tax dividends paid to residents or non-residents. However, Law No. 15,270/2025 has reintroduced tax on dividends: effective 2026, all dividends paid to foreign shareholders are subject to a 10% withholding tax (IRRF). For example, if a subsidiary declares BRL 100,000 in dividends to its foreign parent, BRL 10,000 must be withheld by the subsidiary and paid to the government. There is a transitional rule: profits determined and approved by December 31, 2025 (even if paid later) remain exempt if the corporate acts are properly filed. In practice, companies can use Interest on Equity (JCP) as a distribution method: JCP payments are deductible for IRPJ but face a withholding tax (now 20% from 2026). With IRPJ at 15% and CSLL at 9%, plus the higher 20% WHT on JCP, it may make sense to mix dividends (10% WHT) and JCP to optimize the overall tax burden.

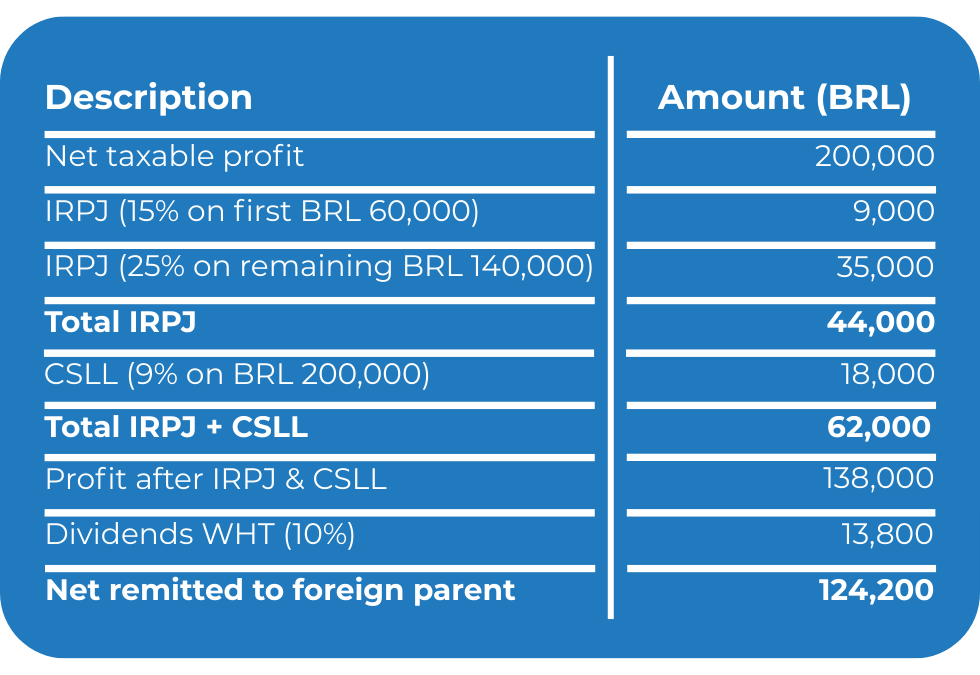

The table below illustrates a simple tax calculation for a foreign-owned Brazilian subsidiary with BRL 200,000 net profit (quarterly):

This example shows how IRPJ (BRL 44,000) and CSLL (BRL 18,000) reduce the original profit of BRL 200,000 to BRL 138,000. After paying 10% WHT on dividends (BRL 13,800), the parent would receive about BRL 124,200. Note that higher IRPJ surtax and CSLL rates will lead to even less remitted cash, underscoring the need for careful tax planning.

Impact on Payroll and Business Operations

Corporate income tax changes can have ripple effects on other parts of the business:

-

Interaction with CSLL: IRPJ is often discussed alongside CSLL, which is 9% (with a 9% surcharge on excess above BRL 60k in combination, effectively 20% on high profits, though CSLL does not have its own additional surtax outside of IRPJ’s combined charge). Together, IRPJ+CSLL reach up to ~34%. An increase in IRPJ payments means companies also have higher CSLL (since it’s on the same profit), straining cash flow when big profits are realized.

-

Cash Flow and Financial Planning: IRPJ is payable quarterly (due the last day of the month following each quarter). Foreign companies must forecast profits and set aside cash for these tax installments. The new rules on Presumed Profit and increased withholding (JCP) mean tax liabilities may rise unexpectedly. A robust cash flow forecast is crucial to avoid liquidity crunches.

-

Reinvestment Strategy: Given the high tax burden on distributed profits, many foreign investors opt to reinvest earnings in Brazil. Retained earnings within the subsidiary avoid immediate withholding costs. Understanding this, companies might delay or reduce dividend distributions in 2026 to reinvest in expansion or capital expenditures, deferring the 10% dividend tax.

-

Indirect Taxes: Although outside IRPJ scope, Brazil’s indirect taxes (PIS, COFINS, ICMS, ISS) affect overall cost. The 2026 tax reform transitions PIS/COFINS to a new CBS VAT. Foreign CFOs should anticipate changes in input credit recovery and administrative systems, as indirect tax credits and refunds may change. Integrated financial planning is needed so that IRPJ payments align with shifts in VAT inputs.

-

Payroll Taxes: Brazil has heavy labor taxes (FGTS, social security, etc.). A higher IRPJ burden could reduce net margins, making it more costly to hire. Companies might revisit staffing plans and consider whether certain roles (like consultants) are subject to withholding or social contributions to optimize costs.

Overall, IRPJ directly hits the bottom line, so any increase in IRPJ rates or base (like the new 10% rule) requires rethinking budgets, prices, and hiring. Strong financial controls and budgeting are essential.

Compliance Requirements in 2026

Compliance with Brazilian tax rules is mandatory and detailed:

-

Accounting and Bookkeeping: Brazilian companies must keep full double-entry accounting records. Financial statements must follow Brazilian GAAP (converged with IFRS). Lucro Real filers (and those required by law) must have audited annual financials. Even Presumed Profit companies need organized books to justify their tax regime choice.

-

SPED and Digital Filing: Brazil’s SPED (Public Digital Bookkeeping System) mandates electronic submission of financial and tax data. Key filings include the SPED-ECD (digital accounting ledger) and SPED-ECF (digital tax ledger for IRPJ/CSLL). For example, in 2025 the deadlines were June 30 (ECD) and July 31 (ECF). Missing the SPED-ECD deadline triggers heavy fines (e.g. R$5,000 per month). Foreign-owned companies must register a digital certificate and file these on time or face penalties.

-

Periodic Tax Reporting: Besides quarterly IRPJ and CSLL payments, companies must submit an annual corporate tax return (Declaração de Informações Socioeconômicas e Fiscais, or ECF) and a Social Contribution payment declaration (DCTF). Each quarterly profit payment requires filling the IRPJ/CSLL form (DIPJ/ECF). Foreign investors should ensure a local tax department or advisor handles these filings in Portuguese.

-

Payroll Reporting: Payroll taxes (FGTS, INSS, IRRF on salaries) have their own electronic systems (eSocial, CAGED, RAIS). These are also under the SPED umbrella and require timely payroll tax deposits and reports.

-

Risks of Non-Compliance: Penalties in Brazil are substantial. Late IRPJ payments incur interest and penalties. Incorrect tax filings can result in fines up to 150% of the underpayment. Transfer pricing errors attract 20% penalties on differences. Not filing SPED documents leads to fixed monthly fines. For foreign companies, non-compliance can also trigger scrutiny under tax treaties or even suspension of import/export privileges.

Foreign investors should establish robust internal controls and ongoing compliance monitoring. This includes training local staff on deadlines, using certified accounting software for SPED, and engaging bilingual accountants or tax advisors who understand international and Brazilian rules.

Common Mistakes Foreign Companies Make

Foreign businesses often stumble on Brazilian taxes in predictable ways:

-

Ignoring PE and Registration Requirements: Operating informally (without a registered entity) risks being taxed retroactively. Always register locally and maintain a CNPJ.

-

Incorrect Tax Regime Choice: Companies sometimes stick with Lucro Presumido despite changes that make it disadvantageous (like the new 10% base increase). They fail to switch to Lucro Real when growth warrants it.

-

Late or Incomplete Filings: Brazil’s many digital filings (ECD, ECF, DCTF, DIRF, etc.) can overwhelm new entrants. Missing an SPED deadline or not filing required disclosures (like CEBT – electronic tax bookkeeping) leads to penalties.

-

Poor Transfer Pricing Documentation: Many foreign firms underestimate Brazil’s arm’s-length rules. Failing to submit TP reports or misunderstanding Brazil’s fixed percentages can cause large IRPJ adjustments.

-

Overlooking Tax Treaties: Not leveraging double tax treaty provisions for withholding taxes (especially relevant now for dividends and interest) can lead to overpayment of tax.

-

Underestimating Indirect Taxes: Failing to account for PIS/COFINS on imports, or incorrectly classifying sales for ICMS/ISS, can inflate costs. (Ensure proper import tax planning and ICMS credit recovery, even though new VAT rules are coming.)

-

Missing Special Rules: For example, not applying the 2025 transitional rules for dividend distribution could cause a surprise 10% tax where earlier profits could have been exempt.

What Should You Do in 2026?

To thrive under the 2026 tax rules, foreign investors should take proactive steps:

-

Analyze Tax Regimes: Re-assess whether Lucro Real or Lucro Presumido is better. Model profits under each, accounting for the new 10% presumed-profit increase and your actual margins. Don’t assume Presumido is always cheaper.

-

Review Corporate Structure: Decide if your Brazilian presence should be a branch or subsidiary. Consult legal counsel on the best setup for liability and repatriation goals. If you plan large investments, a subsidiary with share ownership may be preferable.

-

Update Transfer Pricing Policies: Ensure all intercompany transactions are documented and priced in line with Brazilian rules. If you have a master service agreement or intercompany loan, get local TP reports and certificates ready.

-

Plan Cash Flow: Project your 2026 IRPJ/CSLL obligations based on expected profits, and factor in the 10% on dividends (and 20% on JCP) if you plan distributions. Maintain liquidity to pay quarterly tax installments and spikes.

-

Monitor Compliance: Set up reminders for all SPED and tax deadlines. Consider outsourcing bookkeeping to a local accounting firm (to ensure e-invoicing, NF-e issuance, SPED filings). Invest in an ERP or accounting system configured for Brazilian tax codes.

-

Consult Tax Advisors: Brazil’s tax code is complex and evolving. Engage qualified advisors (English-speaking, if needed) to interpret new laws like LC 224/2025 and Law 15,270/2025 and to plan year-end moves (e.g. approving 2025 profits by Dec 31, 2025 to avoid dividend tax).

-

Leverage Incentives Carefully: If you qualify for any special tax incentives (export credits, regional development programs), check how the 2026 reductions apply. You may need to adjust investment plans if incentives provide less benefit.

Regularly reviewing your operations in light of Brazil’s tax reforms will prevent surprises. Use scenario analysis (profit projections, tax simulations) to make informed decisions rather than waiting until tax time.

Conclusion – Strategic Positioning

Brazil’s tax environment is challenging but manageable with the right partner. CLM Controller is a Brazilian accounting and tax advisory firm with over 40 years of experience supporting international clients. We offer comprehensive English-language services to foreign companies, including:

-

Accounting Outsourcing in Brazil: Full bookkeeping and financial statements prepared by local experts.

-

Corporate Tax Advisory: Strategic advice on IRPJ, CSLL, transfer pricing, and new tax laws.

-

Tax Planning in Brazil: Customized planning to minimize tax liability and align with your business goals.

-

Financial BPO: Outsourced financial back-office functions (accounts payable/receivable, reporting).

-

Payroll Services: Compliance with Brazilian payroll taxes, social contributions, and labor law.

-

International Compliance Support: Guidance on cross-border issues, withholding taxes, and treaty benefits.

By partnering with CLM Controller, foreign investors gain a strategic ally in navigating Brazil’s tax reforms and corporate obligations. Schedule a tax assessment with our specialists to ensure your 2026 Brazil expansion is compliant and optimized for success.

0 Comments