by Marco Aurélio Ribeiro | Feb 17, 2026 | Articles

Introduction Brazil is Latin America’s largest economy and a thriving tech market, making it a strategic destination for foreign technology companies. The country’s huge consumer base and rising digital adoption offer tremendous growth potential. However, operating in...

by Marco Aurélio Ribeiro | Feb 3, 2026 | Articles

Introduction Understanding Brazil’s corporate tax system is crucial for foreign investors entering the market. The main corporate income tax, IRPJ (Imposto de Renda de Pessoa Jurídica), applies to all Brazilian companies and can significantly affect profitability. In...

by Marco Aurélio Ribeiro | Jan 20, 2026 | Articles

Why Tax Planning in Brazil Matters Brazil’s tax system is famously complex and expensive, with layers of federal, state, and municipal taxes that often overlap. Companies are subject to corporate income tax (IRPJ) at 15% on net profits, with an additional 10% on...

by Marco Aurélio Ribeiro | Jan 9, 2026 | Articles

Brazil’s sweeping overhaul of indirect taxes is taking shape. The country’s new dual VAT structure aims to eliminate long-standing inefficiencies and bring Brazil closer to global standards. For directors, finance teams, and tax specialists, the move from...

by Marco Aurélio Ribeiro | Dec 18, 2025 | Articles

The taxation of dividends and profits in Brazil has undergone a major transformation with the enactment of Law No. 15.270 of 2025. Starting in 2026, companies and shareholders will face new rules on withholding income tax, monthly thresholds, annual high income...

by Marco Aurélio Ribeiro | Dec 15, 2025 | Articles

Brazil’s sweeping overhaul of indirect taxes is taking shape. The country’s new dual VAT structure aims to eliminate long-standing inefficiencies and bring Brazil closer to global standards. For directors, finance teams, and tax specialists, the move from...

by Marco Aurélio Ribeiro | Dec 8, 2025 | Articles

Introduction: Navigating Brazil’s Accounting Landscape In 2023, the overall “Brazil Cost” (Custo Brasil) of bureaucracy, taxes, and inefficiencies was estimated around R$1.7 trillion, nearly 20% of GDP. This underscores why Brazil’s regulatory and tax environment is...

by Marco Aurélio Ribeiro | Dec 5, 2025 | Articles

Brazil has updated its minimum tax rules for multinationals under OECD Pillar Two. In October 2025 Brazil’s Federal Revenue (Receita Federal) issued a new Normative Instruction (IN RFB 2282/2025) that incorporates the OECD’s latest Global Anti-Base Erosion (GloBE)...

by Marco Aurélio Ribeiro | Nov 28, 2025 | Articles

Introduction Importing goods into Brazil has long been known for its complex and high-cost structure. Starting in 2026, Brazil’s import costs are changing due to a convergence of new tax laws and operational reforms. Brazil passed a sweeping tax reform (Constitutional...

by Marco Aurélio Ribeiro | Nov 18, 2025 | Articles

Introduction Lucro Real is Brazil’s most complex corporate tax regime, requiring meticulous bookkeeping and compliance. Lucro Real (Portuguese for “Actual Profit”) is one of Brazil’s three main corporate tax regimes, and it is widely regarded as the most complex and...

by Marco Aurélio Ribeiro | Nov 12, 2025 | Articles

Brazil is one of the most attractive and fast-growing e-commerce markets in the world. Every day, millions of Brazilians buy products from abroad. But for foreign entrepreneurs, selling to Brazil comes with an extra layer of complexity — taxes, compliance obligations,...

by Marco Aurélio Ribeiro | Nov 6, 2025 | Articles

Brazil is preparing a major shift in how it taxes dividends distributed to non-residents. Under Bill No. 1,087/2025 (PL 1,087/2025) — approved by the Chamber of Deputies and currently under Senate review — dividends and profits sent abroad will be subject to a 10%...

by Marco Aurélio Ribeiro | Oct 29, 2025 | Articles

1. Understanding the Brazilian Context for FDI Brazil has been one of Latin America’s main destinations for foreign direct investment (FDI). With a diversified economy, strong industrial base, and a consumer market of over 200 million people, international companies...

by Marco Aurélio Ribeiro | Oct 10, 2025 | Articles

Why Invest in Brazil Brazil is not just the largest economy in Latin America — it is a strategic gateway to a market of over 210 million people and a hub for South American trade.For foreign entrepreneurs, Brazil offers a diverse range of opportunities in industries...

by Marco Aurélio Ribeiro | Oct 6, 2025 | Articles

Brazil has become one of the most strategic markets for Chinese companies expanding abroad. Over the last decade, investment from China has surged across multiple sectors — from electric vehicles and mining to technology, energy, and infrastructure. However, entering...

by Marco Aurélio Ribeiro | Oct 1, 2025 | Articles

Brazil offers a lucrative but complex landscape for pharmaceutical and biotechnology companies. As the largest healthcare market in Latin America and one of the top 10 pharmaceutical markets globally, Brazil’s 216+ million population presents vast business...

by Marco Aurélio Ribeiro | Sep 19, 2025 | Articles

Entering the Brazilian market can be challenging for many foreign companies. The complexity of the tax system, regulatory requirements, and cultural differences make it essential to rely on clear and trustworthy information before taking the first steps. With this in...

by Marco Aurélio Ribeiro | Sep 18, 2025 | Articles

Brazil is an agricultural powerhouse and a leading global exporter of soybeans, corn, beef, and cellulose (wood pulp). In 2023, Brazilian agribusiness exports reached a record US$166 billion, nearly half of the country’s total exports. This thriving trade attracts...

by Marco Aurélio Ribeiro | Sep 11, 2025 | Articles

Managing taxation in foreign trade requires advanced technical knowledge, especially when it comes to special customs regimes such as RECOF and Temporary Admission. While they provide significant opportunities for tax and logistical efficiency, these regimes also...

by Rodrigo Ribeiro | Aug 28, 2025 | Articles

Operating a business in Brazil requires strict compliance with bookkeeping in Brazil, a legal obligation that affects all companies, including foreign subsidiaries and branches Every company established in Brazil, including subsidiaries or branches of foreign firms,...

by Rodrigo Ribeiro | Aug 14, 2025 | Articles

Brazil is undergoing a major tax reform that will change the way goods and services are taxed across the country. For telecommunications companies — whether you already operate in Brazil or are planning to start — this reform represents both opportunities and...

by Rodrigo Ribeiro | Aug 5, 2025 | Articles

In international trade, the correct tax classification of goods is a critical step for successful import operations. A simple error in the NCM code (Nomenclature of the Mercosur Common Market) can lead to serious consequences: from incorrect taxation to heavy fines...

by Rodrigo Ribeiro | Jul 21, 2025 | Articles

Brazil is Latin America’s largest economy and, since 2009, China has been its top trading partner. This makes Brazil a prime destination for Chinese investors – but it also means navigating an extremely complex “baroque” tax and accounting system. For example,...

by Rodrigo Ribeiro | Jul 17, 2025 | Articles

Introduction The US’s proposal of a sweeping 50% tariff on Brazilian imports, scheduled to take effect on August 1, 2025, has triggered alarm across markets, media, and governments worldwide. Market leaders believe this is much more than an economic maneuver—it’s a...

by Rodrigo Ribeiro | Jul 1, 2025 | Articles

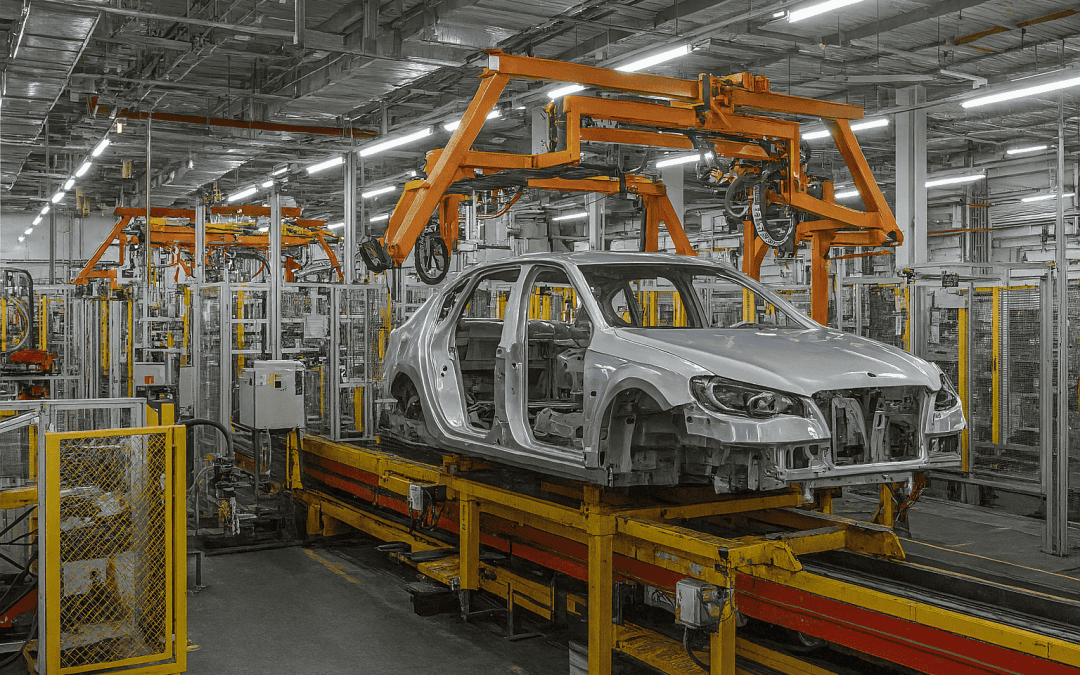

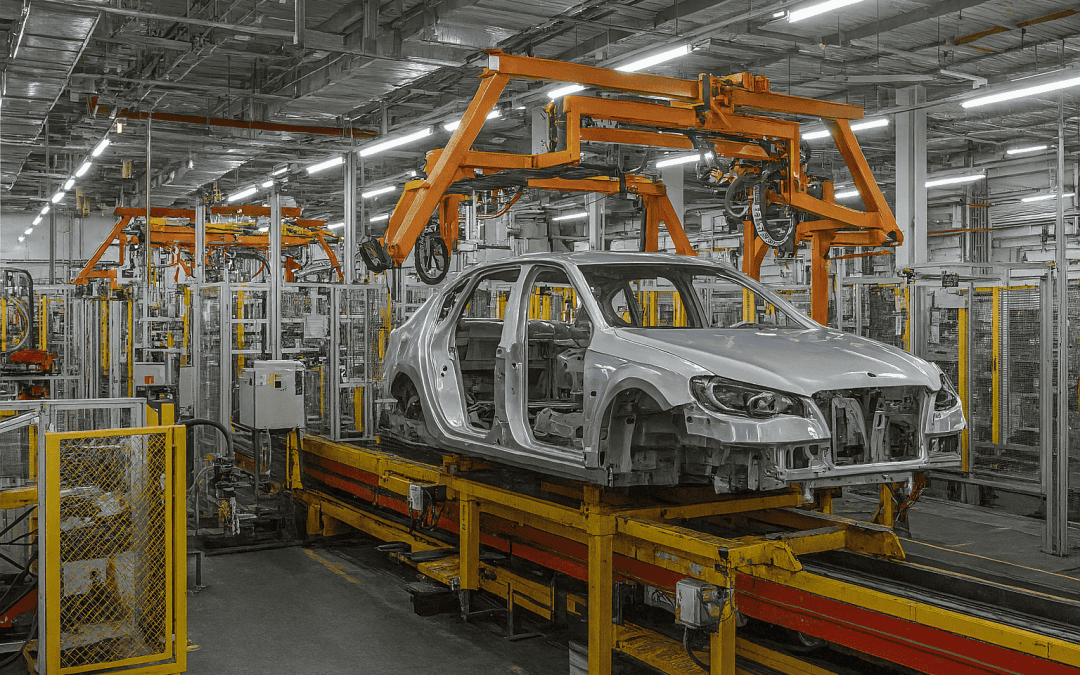

Brazil is home to one of the largest automotive markets in the world. Multinational companies like Volkswagen, Toyota, Stellantis, GM, and Honda have maintained operations in the country for decades. However, foreign companies entering the Brazilian market—especially...

by Rodrigo Ribeiro | Jun 3, 2025 | Articles

Looking to better understand how Brazilian financial operations can impact your investment strategy?Check out our in-depth guide on the IOF (Tax on Financial Operations) — a must-read for companies dealing with loans, currency exchange, insurance, or capital flows in...

by Rodrigo Ribeiro | May 14, 2025 | Articles

The Brazilian tax reform, enacted in January 2025, is one of the most transformative changes in the country’s fiscal landscape in decades. If you are a foreign entrepreneur investing in or operating a business in Brazil, this reform is not just a footnote –...

by Rodrigo Ribeiro | Apr 29, 2025 | Articles

If you are a foreign company or international investor interested in expanding your operations to Brazil, a common question arises: is it necessary to open a company in Brazil to hire a local employee? In most cases, the answer is yes — especially when it comes to...

by Rodrigo Ribeiro | Apr 24, 2025 | Articles

The Brazil telecom sector is one of the most heavily regulated and taxed industries in the country. Accounting in this field goes far beyond basic bookkeeping — it requires strategic tax planning, strict regulatory compliance, and a deep understanding of both national...

by Rodrigo Ribeiro | Apr 15, 2025 | Articles

American entrepreneurs are increasingly eyeing the Brazilian market as a promising destination to expand their businesses. However, when trying to start a bisiness in Brazil, these business owners face a reality that is quite different from that of the U.S.: a highly...

by Rodrigo Ribeiro | Apr 8, 2025 | Articles

The Brazilian tax reform introduces significant changes that directly impact foreign investors and entrepreneurs operating or planning to operate in the country, especially in import and export sectors. With Brazil’s historically complex tax system, the proposed...

by Rodrigo Ribeiro | Mar 31, 2025 | Articles

Brazilian medium and large business owners who move abroad often have many doubts about their tax obligations. After all, leaving the country does not automatically mean being exempt from Brazilian Income Tax. In this article, we will clearly and objectively explain...

by Rodrigo Ribeiro | Mar 18, 2025 | Articles

Overview of Hiring in Brazil for Foreign Business Owners Hiring in Brazil can seem daunting for foreign business owners, but understanding a few basics makes it easier. Brazil offers a large labor market and a workforce skilled in various fields, which is why...

by Rodrigo Ribeiro | Mar 11, 2025 | Articles

Facilitating the opening of foreign company branches in Brazil requires an understanding of applicable laws, taking advantage of benefits, and clarifying common doubts. If your company is looking to expand internationally, Brazil might be the ideal destination—and...

by Rodrigo Ribeiro | Mar 5, 2025 | Articles

Brazil is one of the fastest-growing technology markets, making it an attractive destination for foreign entrepreneurs looking to establish an IT company. However, to operate legally in the country, one must follow certain bureaucratic requirements and comply with all...

by Rodrigo Ribeiro | Feb 26, 2025 | Articles

The construction and operation of data centers in Brazil face significant challenges, especially regarding taxation. With taxes accounting for up to 23% of the total investment, the industry seeks alternatives to reduce costs and increase competitiveness. In addition...

by Rodrigo Ribeiro | Feb 25, 2025 | Articles

Brazil has become an increasingly attractive destination for foreign investors looking to expand their businesses. One of the most advantageous business structures for this purpose is the holding company, which offers benefits such as asset protection, succession...

by Rodrigo Ribeiro | Feb 21, 2025 | Articles

Components of severance pay Severance pay encompasses the financial rights owed to an employee upon the termination of the employment contract. For foreign investors, understanding these components is essential to ensure legal compliance and avoid potential...

by Rodrigo Ribeiro | Jan 22, 2025 | Articles

Overview: Why Is Brazil Changing So Much? Over the past few years, the complexity of the Brazilian tax system has been a major challenge for local companies and, especially, for foreign investors. The Brazilian government, aware that a less bureaucratic and...

by Rodrigo Ribeiro | Dec 10, 2024 | Articles

To legally operate a sports betting company in Brazil, businesses must meet several strict requirements outlined by Brazilian authorities. Below is an in-depth breakdown of these prerequisites: 1. Establish a Brazilian legal Entity Foreign investors must establish a...

by Rodrigo Ribeiro | Sep 9, 2024 | Articles

1. What Does it mean to establish a business in Brazil? To operate legally in Brazil, businesses need to be registered with the government, which provides a unique identifier for tax and legal purposes. Foreign entrepreneurs are allowed to establish a business...

by Marco Aurélio Ribeiro | Feb 17, 2026 | Articles

Introduction Importing goods into Brazil has long been known for its complex and high-cost structure. Starting in 2026, Brazil’s import costs are changing due to a convergence of new tax laws and operational reforms. Brazil passed a sweeping tax reform (Constitutional...