How Brazil’s Tax Reform Will Impact Telecommunications Companies

Brazil is undergoing a major tax reform that will change the way goods and services are taxed across the country. For telecommunications companies — whether you already operate in Brazil or are planning to start — this reform represents both opportunities and...

Tax risks in importing: Common classification errors and how to avoid them

In international trade, the correct tax classification of goods is a critical step for successful import operations. A simple error in the NCM code (Nomenclature of the Mercosur Common Market) can lead to serious consequences: from incorrect taxation to heavy fines...

Accounting and Taxes in Brazil for Chinese Businesses

Brazil is Latin America’s largest economy and, since 2009, China has been its top trading partner. This makes Brazil a prime destination for Chinese investors – but it also means navigating an extremely complex “baroque” tax and accounting system. For example,...

Impact of US 50% tariff on Brazilian exporters

Introduction The US’s proposal of a sweeping 50% tariff on Brazilian imports, scheduled to take effect on August 1, 2025, has triggered alarm across markets, media, and governments worldwide. Market leaders believe this is much more than an economic maneuver—it’s a...

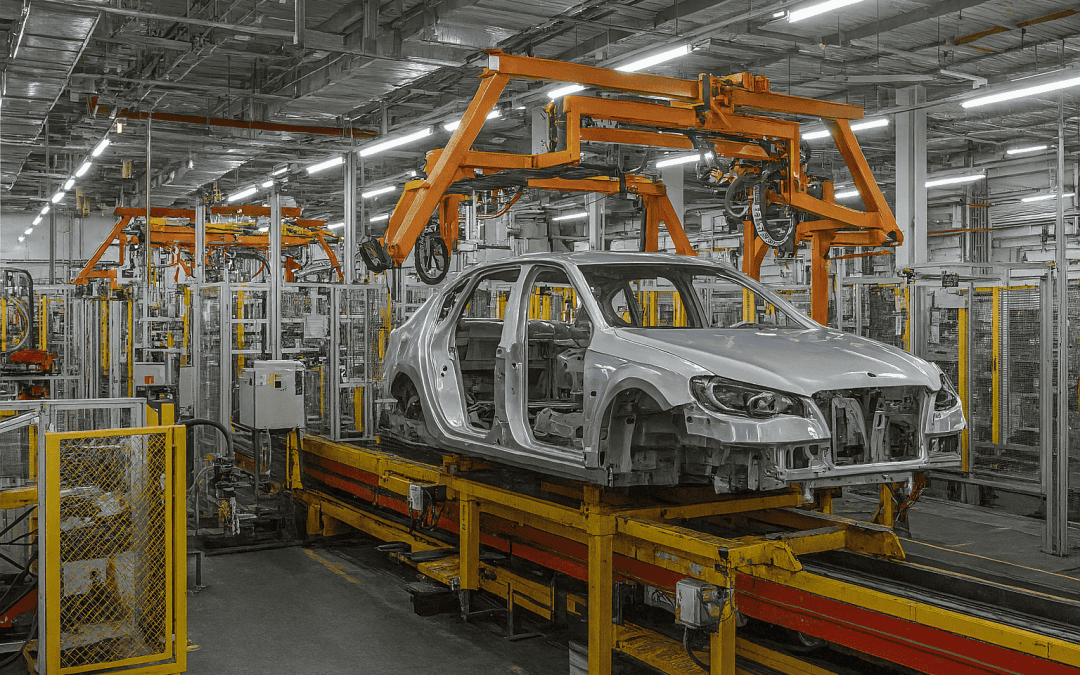

How Does Accounting Work for Foreign Automotive Industries Operating in Brazil?

Brazil is home to one of the largest automotive markets in the world. Multinational companies like Volkswagen, Toyota, Stellantis, GM, and Honda have maintained operations in the country for decades. However, foreign companies entering the Brazilian market—especially...

Brazil’s Automotive Industry: A Comprehensive Guide for Foreign Investors

Looking to better understand how Brazilian financial operations can impact your investment strategy?Check out our in-depth guide on the IOF (Tax on Financial Operations) — a must-read for companies dealing with loans, currency exchange, insurance, or capital flows in...

Tax Reform in Brazil What Foreign Entrepreneurs Need to Know About the New VAT

The Brazilian tax reform, enacted in January 2025, is one of the most transformative changes in the country’s fiscal landscape in decades. If you are a foreign entrepreneur investing in or operating a business in Brazil, this reform is not just a footnote –...

Do you need a company in Brazil to hire employees?

If you are a foreign company or international investor interested in expanding your operations to Brazil, a common question arises: is it necessary to open a company in Brazil to hire a local employee? In most cases, the answer is yes — especially when it comes to...